The broadly steady period for crude prices has followed the 30th November OPEC decision to cut production by a targeted 1.2 Mb/d and the 10 December decision by Russia and some other non-OPEC countries to cut output by a targeted 0.6 Mb/d in coordination with OPEC. These announcements caused a quick surge in prices of $7-8 for front-month ICE Brent and $5-6 for front-month NYMEX WTI.

Since that surge – in other words, since mid-December – front-month ICE Brent has been trading mainly between $53.50 and $56.50 and is currently at the very top of the range. Similarly, front-month NYMEX WTI has been trading mainly between $51 and $54 over the same timeframe and is currently near the top of the range.

What are the key drivers of the range-bound market? OPEC production cuts vs. recovering US output. The key fundamental drivers of the market, for the time being, are on the supply side, where there are two main factors.

The upward pressure is coming from OPEC crude production cuts; this is setting the floor. The downward pressure is coming from the nascent recovery in US crude production, driven by shale oil; output is expected to grow steadily as 2017 progresses, and this is setting the ceiling. Consequently, the crude oil prices continue to be range-bound (between 49.80 and 55), as has been the case since mid-December.

As a result, we recommend below option strategies using right options, thereby, one can benefit from certain returns.

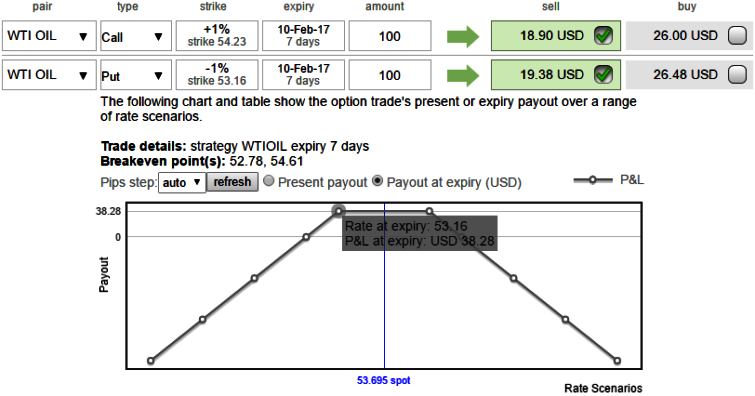

Naked Strangle Shorting:

As shown in the diagram, initiate shorts in 1W OTM put (1% strike difference referring lower cap) and short OTM call simultaneously of the same expiry (1% strike referring upper cap) (we reiterate, preferably short term for maturity is desired).

Overview: Slightly bearish in short term but sideways in the medium term.

Time frame: 7 to 10 days

The strategy is likely to derive the maximum returns as long as the underlying WTI crude spot price on expiry keeps trading between 54.23 and 53.16 levels only as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data