WTI crude oil trades slightly weak ahead of US NFP data. It hit a low of $83.57 yesterday and is currently trading at $83.80.

Opec oil output increased for a second month as Nigeria and Iran hiked its supplies. The increase in demand is due to the summer in the US supporting oil at lower levels.

Major factors for crude oil price movement-

US dollar index (Bearish)- Positive for Crude.

Major resistance - 106.20/107.

Major support- 105.50/104.

Geopolitical tension- improvement in negotiations between Israel and Hamasa ( negative for crude).

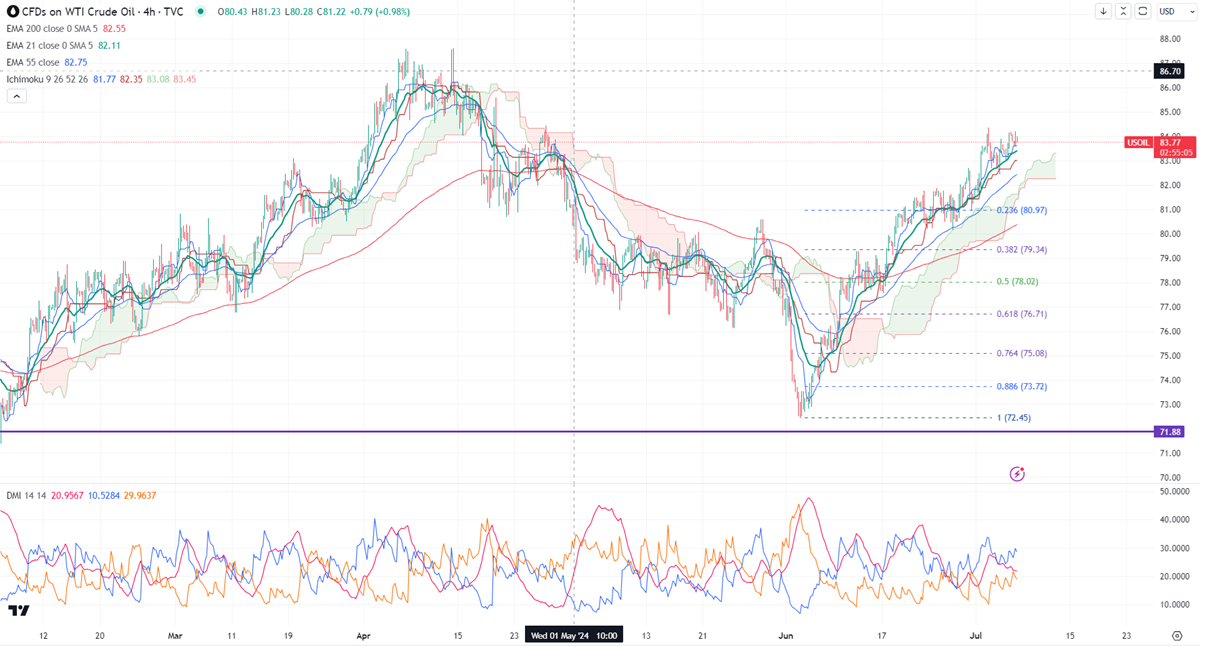

Ichimoku analysis (4- hour chart)

Tenken-Sen- $83.60

Kijun-Sen- $83

The immediate resistance is around $84.35. Any jump above the target of $85/$86. On the lower side, near-term support is around $83. Any breach below will drag the commodity down to $82.50/$81.75/$80.97/80.

It is good to buy on dips around $83 with SL around $82 for a TP of $85