Crude oil withstood a wild ride over the past two weeks, first breaking above $65/bbl (Brent) on news of the Forties pipeline outage but collapsing after on increased rhetoric around exit strategy from the current production cut deal, U-turns from Nigeria and Libya in refusing to abide by last month’s agreed output caps, OPEC’s higher shale supply projections for 2018 and weak DOE inventory numbers.

These moves in crude correlate only loosely with moves in petro-FX – indeed, oil and oil currencies have decoupled for a while now –but only serve to increase the marginal volatility of CAD and CAD-crosses at a time when the currency is being buffeted by cross-currents of BoC policy shifts and international trade frictions (NAFTA).

Monetary policy to be more decisive than oil prices. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014 (refer 3rd chart), and our USD rates projections can realistically drag the USDCAD to 1.20.

The Bank of Canada (BoC) has become extra vigilant again after CAD appreciated comprehensively succeeding two rate hikes. In view of numerous lingering risks (inflation, crude price, NAFTA) the BoC does not want to be overly optimistic. We assume that for the time being the BoC will initially follow the Fed’s rate hike speed so as to prevent strong CAD appreciation against USD. The better growth outlook in Canada, as well as the more stable political environment, will, however, allow gradual CAD appreciation in the future.

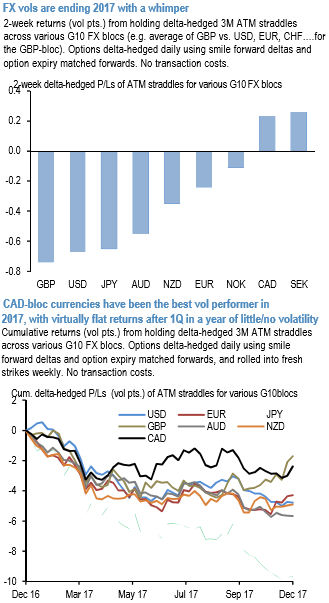

As the 1st chart displays, CAD-crosses have been among the better performing vol blocs in recent times, and the clear outperformer on a relative basis within G10 currencies over the past year with virtually flat returns since the broad vol collapse in 1Q even as others – with the notable exception of GBP – continued to crumble (2nd chart).

Yet CAD implied vols have not re-priced in any meaningful fashion to reflect this delivery: USDCAD 3M ATMs are up only 0.2 vols over the past month, crosses such as EURCAD (+0.5) and CADJPY (-0.2) have not fared a whole lot better. Part of this inertia probably reflects seasonal year-end vol softness, but if this state of affairs persists even after markets return in the New Year when both interest rate and trade talks pick up renewed steam, it should be an opportunity to pick up cheap volatility.

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise