It is projected that AUD to drop against dollar and yen to 0.76 and 84.070 levels in next few months, so long as markets continue to price further Fed interest rate rises in 2018, along with a neutral RBA outlook deep into 2018 and commodity prices remaining around recent levels.

The corrective decline in AUDJPY which started on 5th of this month could reach 86.9269 levels, but should eventually give way to a retest of 1.12 as long as AU economic data remains supportive and AU commodity prices outperform

While as per the JP Morgan’s projections, AUDJPY is seen at 79 by Q1’2018.

Australia' trade deficit widened to AUD 0.63 billion in November of 2017 from a downwardly revised AUD 0.30 billion in the prior month and missing market expectations of an AUD 0.55 billion surplus. Imports rose 1 percent to a record high of AUD 32.48 billion while exports were unchanged at AUD 31.85 billion. Considering January to November, the trade balance posted a surplus of AUD 12.17 billion, compared to an AUD 18.96 billion deficit in the same period of 2016.

Hedging framework (AUDJPY):

On hedging grounds, risk-averse traders, capitalizing ongoing rallies of the underlying spot FX, we advocate snapping rallies and buying a 6M 84.250 AUDJPY one-touch put.

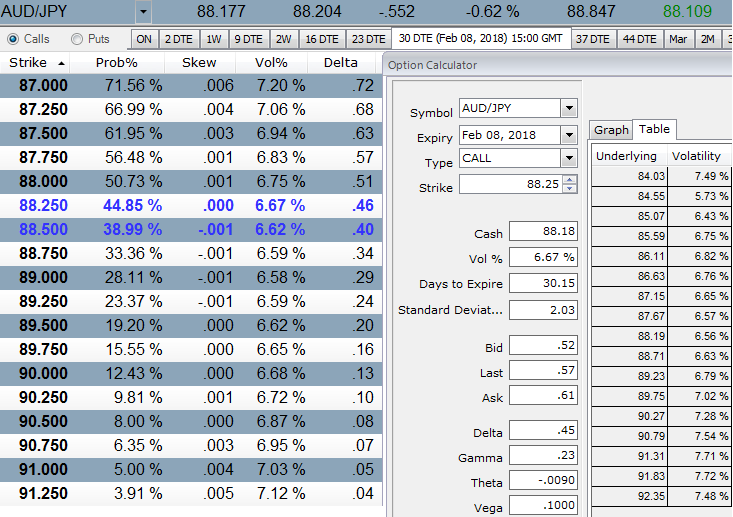

Please be noted that the 1m ATM IVs of this pair is trading at 6.67%. While (1%) OTM put seems to be overpriced at 23% more than NPV which is a disparity between IVs of this tenor and option premium pricing.

Those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY put spreads at 89/84.250 strikes in 1:0.753 notionals.

Vols of 1m tenors are also at the lower side which is conducive for option writers, while skews have positively stretched on either side (both OTM put and calls). Hence, we’ve chosen ITM striking put as we agree with JP Morgan’s projections.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -44 levels (bearish), while hourly JPY spot index was at shy above 108 (bullish) while articulating at 11:32 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data