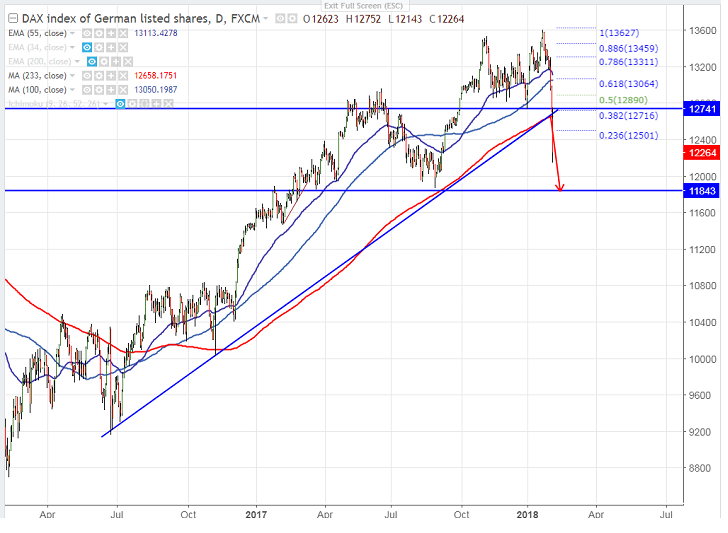

- As per our analysis DAX index has shown a huge sell off following footsteps of US equity markets. US stock indices Dow declined 1175 points yesterday biggest drop in history. The biggest fall was mainly due to spiking inflation and rising bond yields.

- DAX index declined more than 6% for the past two days and hits low of 12143 almost 1500 points from the all-time high of 13605. The index is in oversold zone and a minor jump is possible.

- The minor bullishness can be seen only if it closes above 12657 (233- day MA) and any close above will take the index to next level till 12890/13050 (100- day MA). It should break above 13600 for further bullishness.

- On the lower side, near term major support is around 11800 and any break below will drag the index till 11400/11000.

It is good to sell on rallies around 12550-600 with SL around 13200 for the TP of 11860.