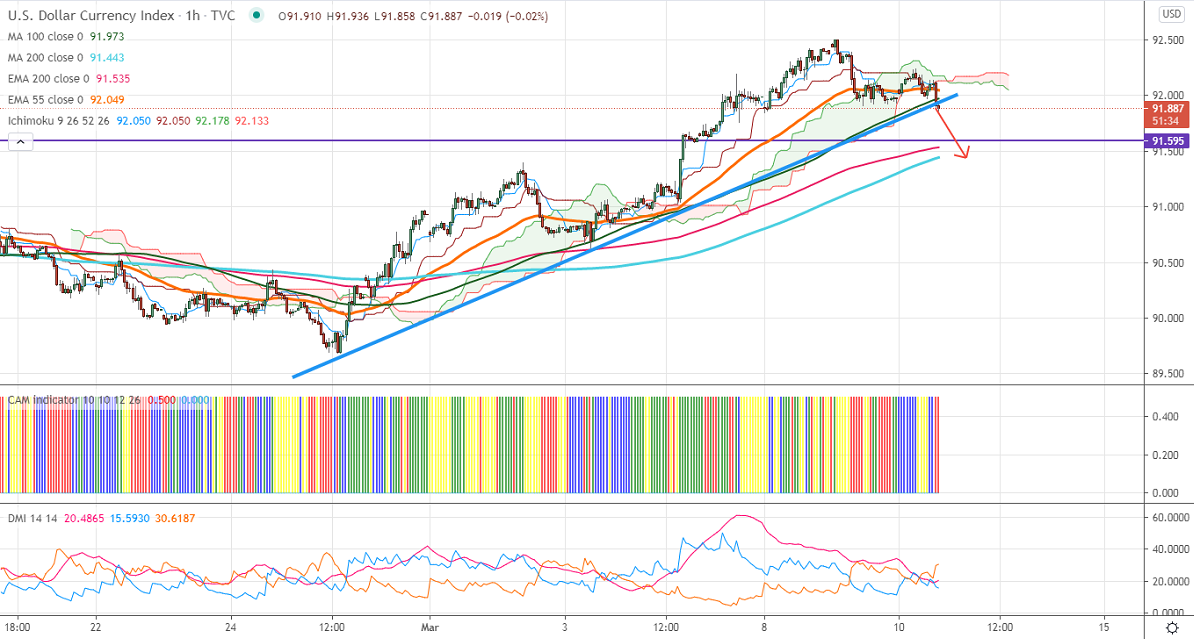

Short term trend – Bullish

Intraday trend – Bearish

Ichimoku Analysis (1-Hour chart)

Tenken-Sen- 92.06

Kijun-Sen- 92.06

US Dollar index has shown a minor decline after US CPI data. The inflation data came at 1.3% YoY compared to a forecast of 1.4%. While CPI ex-food and energy at 0.1% m/m vs 0.2% expected. US 10- year declined more than 1.5% after the data. Market eyes US bond auction at 18:00 GMT for further direction. The index hits an intraday high of 92.195 and is currently trading around 92.136.

The near-term resistance is around 92.25, convincing close above confirms minor bullishness. A jump to 92.76 (161.8% fib)/93 is possible.

The index is trading slightly below 91.95 (100- H MA); any indicative break below will take the index to 91.43 (200- H MA)/91.25.

Ichimoku analysis- DXY is trading below Tenken-Sen and Kijun –Sen (92.06). It is holding below the Ichimoku cloud (92.12).

Indicator (1 Hour chart)

CAM indicator – Bearish

Directional movement index –Bearish

It is good to sell on rallies around 92 with SL around 92.25 for a TP of 91.42.