2017 hasn’t been favorable to the dollar, dropped by 11.03% in this year. But we were tactically long USD (USDJPY, USDCHF and a CADCHF proxy) as we expected a confluence of economic momentum, fiscal reform and the Fed to lift sentiment.

While DXY futures (US dollar index) which measure the greenback’s strength against a trade-weighted basket of six major currencies has constantly dipped below DMAs from last 1 week or so, currently at 92.34.

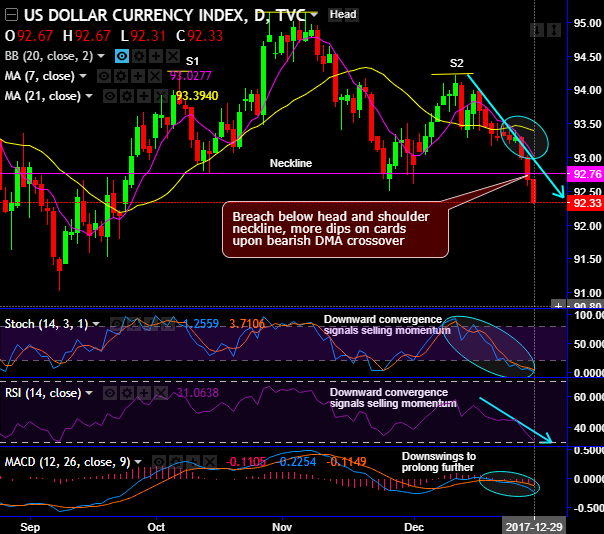

Downswings break below strong support at 92.76 (i.e. neckline of head and shoulder pattern) to indicate more selling interests.

Forms head and shoulder pattern with shoulder 1 at 94.27, shoulder 2 at 94.22 and head at 95.15 levels (refer daily chart).

As the major trend goes into absolutely corrective phase, you could easily observe constant slumps after failure swings at peaks of 103.82 levels to the recent lows of 91.01 levels; the dollar downtrend hits 3-months lows again as it restrained below 7EMAs.

Both leading & lagging oscillators to substantiate this bearish stance. Accordingly, on the eve of New Year, bears are now on the verge of hitting 3-months lows.

Strong support is observed at 91.84-01 levels and stiff resistance is at 95.3755 levels.

Contemplating the fed’s hiking cycle, the dollar may resume uptrend, and the swings could go in either direction with the major trend goes into consolidation phase or the resumption of the uptrend.

Hence, in order to arrest the potential FX risks on either side, we advocate the below recommendation:

Initiate long in 2w ATM +0.51 delta call, and simultaneously buy ATM -0.49 delta put of the same tenor for the net debit.

Well, this options trading strategy that is used on hedging grounds when the options trader ponders that the underlying spot FX prices would experience significant volatility but not sure of the direction of the swings.

FxWirePro launches Absolute Return Managed Program. For more details, visit: