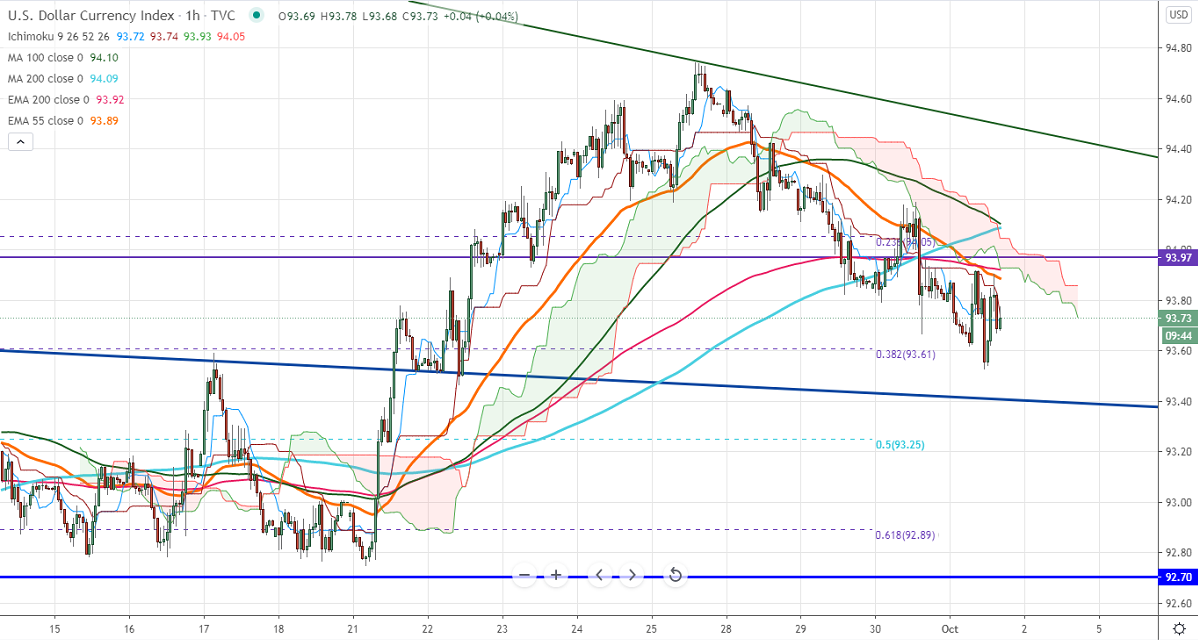

Ichimoku Analysis (1-hour chart)

Tenken-Sen- 93.72

Kijun-Sen- 93.83

US Dollar index is trading in a narrow range between 94.19 and 93.62 for the past two trading days. The uncertainty over fiscal stimulus in the US is dragging the dollar up and down to a greater extent. The economic data came mixed with the US ISM manufacturing index missed expectations. While Jobless claims for the week ended Sep came at 837K vs estimate of 850K. It hits an intraday low of 93.91 and is currently trading around 93.71.

On the flipside, near-term support is around 93.60, any violation below targets 93.40/93/92.66. Significant bearishness only if it breaks below 91.55.

The index is strong resistance at 94.75, an indicative break beyond will take the index till 95.70/96.05.

It is good to sell on rallies around 93.80-85 with SL around 94.20 for the TP of 93/92.66.