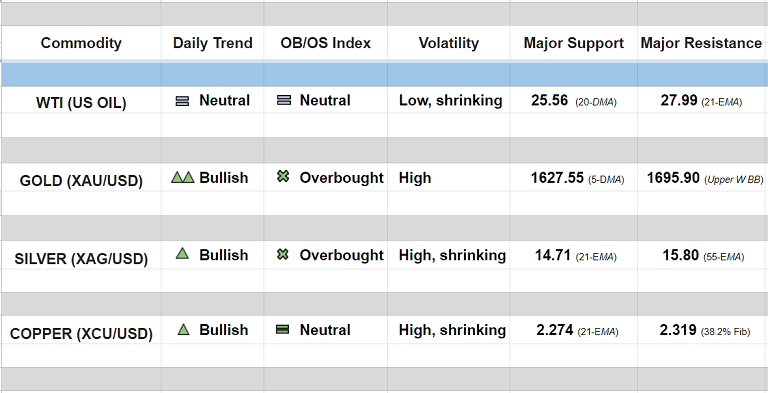

Daily Commodity Tracker (12:00 GMT)

WTI (US OIL):

Major trend - Strongly bearish; Minor trend - Neutral

Oscillators: Neutral (bias higher)

Bollinger Bands: Shrinking on the daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 27.21/ 26.29

GOLD (XAU/USD):

Major trend - Turning slightly bullish; Minor trend - Bullish

Oscillators: At overbought

Bollinger Bands: Volatility remains high

Intraday High/Low: 1675.605/ 1644.922

SILVER (XAG/USD):

Major trend - Strongly bearish; Minor trend - Bullish

Oscillators: At overbought

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 15.47/ 14.98

COPPER (XCU/USD):

Major trend - Strongly bearish; Minor trend - Bullish

Oscillators: Neutral (Bias higher)

Bollinger Bands: Shrinking on Daily charts, Widening on Weekly and Monthly charts

Intraday High/Low: 2.316/ 2.217

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different