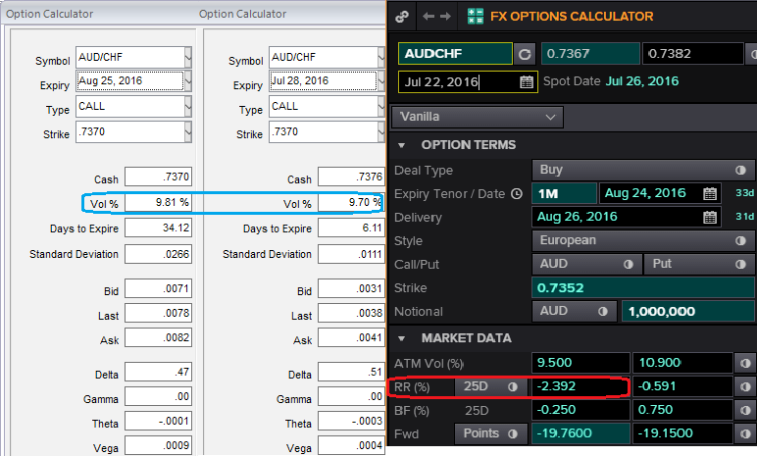

1W ATM IVs of this pair is perceived at around 9.7%, which is one of the least IVs to perceive among G10 currency space.

Technically, the pair drifts in the range between upper strikes at 0.7550 and lower strikes at 0.6800 levels.

At current spot at 0.7375, it has been oscillating between this range for last 8-10 months or so. Hence, with range bounded trend and lower IVs keeping in consideration, we would like to remain in the safe zone by achieving certain returns through below option strategy.

Strategy: Long Put Butterfly Spread

Please be noted that the 25-delta risk reversals flash negative numbers that indicate hedging activities for huge bearish risks amid range bounded trend, which is why we deploy puts in the below strategy.

The recommendation on buying (-1%) OTM -0.25 delta put while simultaneously shorting ATM put with similar expiries and buy (1%) ITM -0.90 delta put while simultaneously shorting another ATM put with similar expiries.

This strategy is structured for a larger probability of earning a smaller but certain profit as AUDCHF is perceived to have a low volatility.

Hence, cash inflow would be certain as long as volatility is stagnant or even decreases.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data