The delta risk reversal for 1m contracts have shown bearish signals back again and long term (1M-1Y) put contracts are also on higher demand.

While the pair is still to percieve the highest implied volatility for 1W at the money contracts among G7 currency space, almost nearing 12%, certainly rising higher which is favorable for those look for option writings.

With this qualitative reasoning, we recommend arresting further downside risks of this pair by hedging through Put Ratio back Spread.

Expect the underlying currencies EURUSD in this case to make a large move on the downside.

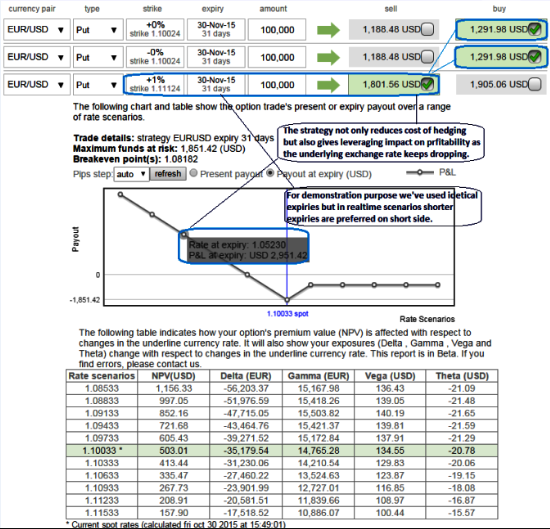

As shown in the figure purchase 1m 2 lots of At-The-Money -0.48 delta puts and sell 1w one lot of (1%) In-The-Money put option usually in the ratio of 2:1.

The short ITM puts funds to the purchase of the greater number of long puts and the position is entered for no cost or a net credit. The delta of combined positions should be around -0.34 with slightly negative theta value.

The underlying exchange rate has to make substantial move on the downside for the gains in long puts to overcome the losses in the short puts as the maximum loss is at the long strike. Give it a longer time to expiration so as to make a substantial move on the downside.

FxWirePro: Deploy EUR/USD PRBS to hedge spot FX downside risks

Friday, October 30, 2015 11:39 AM UTC

Editor's Picks

- Market Data

Most Popular