The Bank of England and the Federal Reserve are the most likely among the major central banks to raises rates in Q2.

Brexit negotiations are proceeding. Stage three of the negotiations will begin in Q2. This is the final stage and involves negotiating the new relationship and tying up some loose ends, and there are several substantial ones (e.g., the Irish border). Progress was deemed sufficient on the terms of the separation (e.g., UK’s financial obligations) and on the transition to push negotiations along.

Despite the apparent progress on Brexit, the UK may still be headed toward a political crisis. It could come as early as next quarter. Significant Tory losses in the local elections in May could spur a leadership challenge. The strategy of most of the potential alternative candidates would seem likely to result in a hard Brexit.

All these fundamental driving forces of GBP are factored in by the shrewd hedgers, and accordingly, the smart hedging is suggested as shown below.

Hedging framework:

3-Way Options straddle versus put

Spread ratio: (Long 1: Long 1: Short 1)

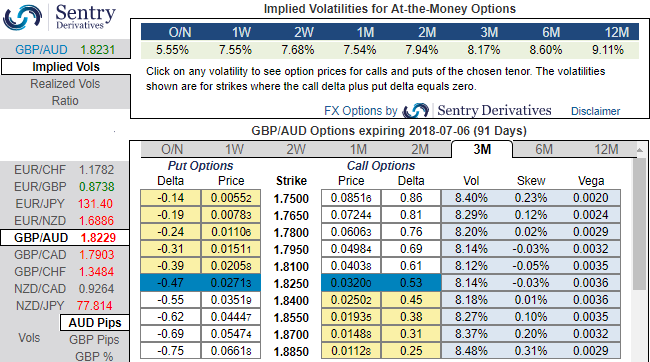

Rationale: Please be noted that 3m skews are stretched on either side, ATM options (both calls/puts) have more likelihood to expire in the money (refer 1st nutshell) and also be noted that we eyed on OTM puts as 1m skews are indicating bullish risks (refer 2nd nutshell), but 1m (1%) OTM puts of this pair seem to be trading at exorbitant prices.

OTM puts cost 26% more than NPV. While 1m IVs are just a tad below 7.5%, it is deemed to be disparity (refer 3rd nutshell).

Hence, we reckon that writing such exorbitant put option is beneficial as there exists the disparity between IVs and option pricing.

Simultaneously, we encourage vega longs and short thetas in the non-directional trending pair but slightly favors bearish strategy as the vega signifies the sensitivity of an option’s value owing to a shift in volatility. It is usually expressed as the change in premium value per 1% change in implied volatility.

The execution: Initiate long in GBPAUD 3m at the money -0.49 delta put, long 3m at the money +0.51 delta call and simultaneously, short theta in 1m (1%) out of the money put with positive theta or closer to zero.Theta is positive; time decay is bad for a buyer, but good for an option writer.

Currency Strength Index: FxWirePro's hourly GBP spot index has turned into 19 (which is neutral), while hourly AUD spot index was at shy above -21 (mildly bearish) while articulating (at 11:12 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch