NZDJPY has been oscillating between a range of 83.910 and 75.626 levels since mid-November 2016 and we foresee to continue the same range.

Japan posted a JPY 113.4 billion trade surplus in November of 2017, following a JPY 146.5 billion surplus a year earlier and beating market expectations of a JPY 55 billion deficit. Exports jumped 16.2 percent year-on-year, above forecasts of a 14.6 percent rise, with sales to China hitting a record high value. Imports were the highest since July of 2015. While New Zealand’s trade deficit widened to NZD 871 million in October of 2017 compared to an NZD 798 million gap in the same month of the previous year and expectations of an NZD 750 million deficit.

With these trade figures, the base case scenario is foreseen for another quarter or so in a narrow range, with NZDJPY 83.910 and 75.626 likely to capture the range for Q1’2018. Suppose any break-out of NZDJPY 79.490 does, however, seem almost inevitable once the BOJ signals a change in policy and is more likely on any time-scale than a sustained move above NZDJPY 83.780 levels.

The Kiwi dollar finally experienced a sustained rally after being mired at the lows for almost two months. The appointment of Orr as the new RBNZ governor generated huge relief for a market that had grown pessimistic about the new Labour-led government’s economic policies. AUD was dragged higher on NZD’s coattails, by rising iron ore prices, and a solid Australian employment report.

Well, contemplating previous major trend of NZDJPY we see rosy prospects to use the upswings of this pair as a better opportunity for reducing the cost of hedging for the bearish risks.

OTC Outlook and hedging strategies:

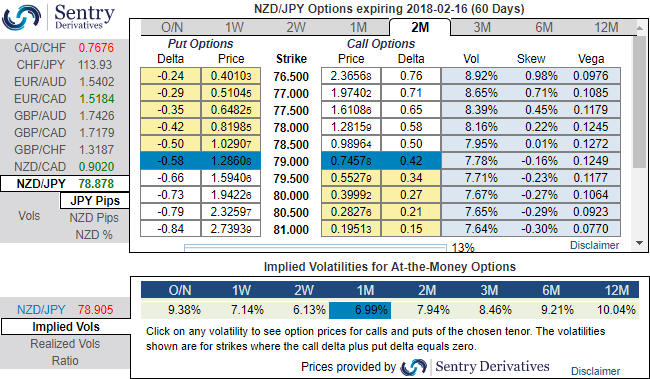

ATM IVs of NZDJPY is trading between 6.13% and 7.94% for 2w and 2m tenors respectively and positively skewed IVs of 2m tenors are evidencing bearish hedging interests. Bids for OTM puts upto 76.50 is noticeable to signify downside risks.

Thus, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 1M ATM -0.49 delta Put + Short 1m (1%) OTM Put with lower Strike Price with net delta should be at -0.46. Please be noted that the positive payoff structure would be generated as it keeps dipping below current levels but remain within OT strikes.

For a net debit, bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Aggressive bears can bid NZDJPY 1m IVs & RR to buy NZDJPY ATM -0.49 delta put of near-month tenors.

Currency Strength Index: FxWirePro's hourly NZD spot index is inching towards 56 levels (which is bullish), while hourly JPY spot index was at shy above 83 (bullish) while articulating (at 11:54 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts