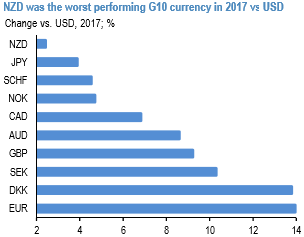

NZD was the worst performing G10 currency vs USD in 2017(refer above chart). A combination of weaker-than-expected economic growth, tighter funding conditions, slowing net immigration and a change of government all conspired to relegate NZD to wooden spoon territory last year.

We don’t think many of these factors will be too different in 2018, and so still see scope for underperformance from NZD in the year ahead.

We foresee that NZDJPY to breach recent ranges to the downside in 1H’18 and forecast the currency at JPY 75.153 by mid-2018. From there, it is reckoned that the currency should settle at USD 72.427 levels by the year-end.

On the flip side, the Japanese yen once again continues the appreciation trend seen over the past few days. The reason is a recent rise in speculation that the Bank of Japan (BoJ) might tighten its monetary policy this year. This speculation was further fuelled yesterday by the central bank’s announcement to be buying fewer long-dated government bonds as part of its asset purchasing programme in the future. Both yields and JPY went up significantly as a result.

Since inflation in Japan remains well under the envisaged target, the Bank of Japan (BoJ) is condemned to maintaining its ultra-expansionary monetary policy for the foreseeable future. The fact that the government is continuing with its Abenomics programme also points towards a continued expansionary monetary policy over the coming two years.

We, therefore, expect a weaker yen, in particular, if the US central bank Fed continues to hike interest rates as expected and the ECB slowly tapers its asset purchasing scheme.

Hence, on hedging perspective, short hedges are recommended by shorting deceptive rallies for southward targets.

Well, at spot reference: 77.052, contemplating above fundamental aspects in the intermediate trend, we recommend shorting futures contracts of mid-month month tenors on hedging grounds as the underlying spot FX likely to target southwards upto 75.153 levels in the medium run.

The holders in a futures contract are expected to maintain margins in order to open and maintain a short futures position.

Currency Strength Index: FxWirePro's hourly JPY spot index was at -8 (neutral) while articulating (at 08:23 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty