We continue to look for a lower NZD over the coming year, as tight financial conditions, weaker growth, a housing market that has peaked and a policy rate more likely to go down than up in the next year all weigh on the Kiwi.

A combination of weaker data and uncertainty ahead of the general election has driven a decent position adjustment in NZD of late.

The outcome of the September Election still remains unknown. Over the next week, we expect the first place and incumbent National Party and minor party NZ First to reach an agreement to form a government, whether in coalition or confidence and supply arrangement. While NZ First’s anti-immigration stance has created some uncertainty around New Zealand’s booming migration backdrop, it is worth remembering this party has been involved in prior administrations without their more aggressive policies being implemented.

We, therefore, do not expect any material policy changes to emerge from the negotiations or from NZ First’s involvement in the parliament. This limits the implications for NZD.

OTC Outlook

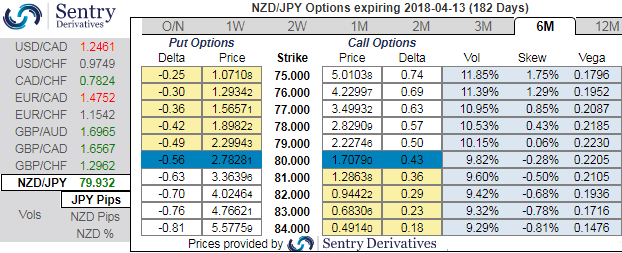

ATM IVs of NZDJPY is trading at 9.37% and 10.10% for 3 and 6m tenors respectively.

Please note that positively skewed IVs signify hedgers’ interests in OTM put strikes, it is deemed as the bearish risks are mounting (the positively skewed IVs are bidding for strikes upto 75).

Also, be noted that the options with a higher IV cost more which is why in this case OTM puts have been preferred over ATM instruments. This is intuitive due to the higher likelihood of the market ‘swinging’ in your favor. If IV increases and you are holding an option, this is good. When you write an option, the seller wants IV to remain lower level or to shrink so the premium also fades away.

Option Strategy:

Thus, conservative hedgers can prefer the below strategy:

Debit Put Spread = Go long 6M ATM -0.49 delta Put + Short 2m (1%) OTM Put with lower Strike Price with net delta should be at -0.40.

For a net debit bear put spread reduces the cost of trade by the premium collected (on the shorts of OTM put) and keeps option trader to participate in downward moves and any upswings in abrupt.

Moreover, the risk is capped to the extent of initial premium paid, as opposed to unlimited risk when short selling the underlying outright.

However, put options have a limited lifespan. If the underlying FX price does not move below the strike price before the option expiration date, the put option will expire worthless.

Alternatively, aggressive bears can bid NZDJPY 1m2m IVs & RR and buy 75 NZDJPY OTM put of mid-month tenors, sell a 1m in premium-rebate notionals.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data