Last month, the central bank of Turkey (CBT) left its benchmark one-week repo rate at 8 pct in its last monetary policy meeting on June 15th, 2017 as widely expected. Policymakers noticed the economic recovery is gathering pace although inflationary risks persist. Yet, the inflation remained in double digits for the fourth month at 11.72 pct in May and food inflation reached the highest since 2010. The central bank added that a tight stance in monetary policy will be maintained until the inflation outlook improves

The last week again Turkish central bank held meetings with senior banking peers to presage them against offering FX swap deposit products to customers.

CBT has assessed that these swap products account for the bulk of the dollarization which the local economy has seen over the past year. Dollarization is reflected by the strong increase in FX deposits compared with lira deposits in the banking system, as per the local media sources.

Following the meeting with the CB, one of the leading Turkish banks has reportedly withdrawn this type of deposit from its offerings.

This policy response showcases the typical interventionist approach which Turkish authorities often prefer when faced with market adversity - the lira has weakened sharply over the past week, and this has reignited the search for 'channels' or 'instruments' by which market participants are 'betting' against the lira.

Remember when the lira came under pressure following the coup attempt last year, President Erdogan famously appealed to the public to convert their FX holdings to lira - the public did not comply, but policymakers have kept up their fight against dollarization. The problem, of course, is that dollarization occurs because the market has less confidence in the lira than in the dollar.

Option Strategy (ATM straddles):

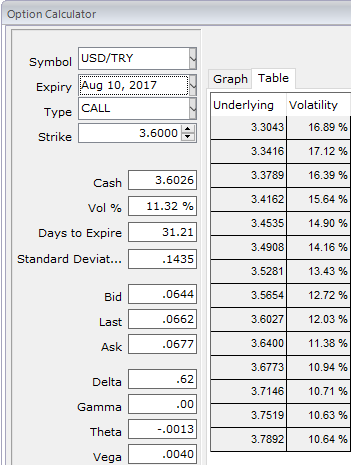

Please be noted that the IVs of 1m tenor have been flashing higher prints (11.65%), we think these vols are quite sensible on above stated fundamental news and favorable for long legs.

For those whose foresee uncertain swings and dramatic moves on either side and prefer to remain in the safe zone, we recommend this straddle considering luring IVs.

Thereby, one can benefit from certain returns by adding long on both calls and puts.

Here goes the strategy this way, add longs 1m ATM striking -0.49 delta put and simultaneously, ATM striking +0.51 delta call of the same expiry.

Maximum returns for the straddle is achieved when the underlying USDTRY spot prices on expiry either spikes or dips dramatically.

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge