USDTRY has been slightly volatile in recent days, but ultimately range-bound. Investors should watch the exchange rate closely going forward as the demand for dollars has shot up in the banking system.

Recently, CBT's one-week swap auction witnessed record-high $10bn demand, with CBT filling only $1.25bn of this. Until a month ago, dollar demand at these swap auctions averaged under $2bn.

Local media report that the demand for dollars is higher because of seasonal requirements, which is probably true. If routine seasonality is the driver, then it will likely not move the lira by much either way.

Nevertheless, there is something not so routine about this year - CBT is managing demand and supply of funds in the banking system using a tightly-controlled set of market operations.

This set up can easily be accident-prone when the underlying volume of demand shifts rapidly - a spike in volatility would be the obvious outcome of watching out for.

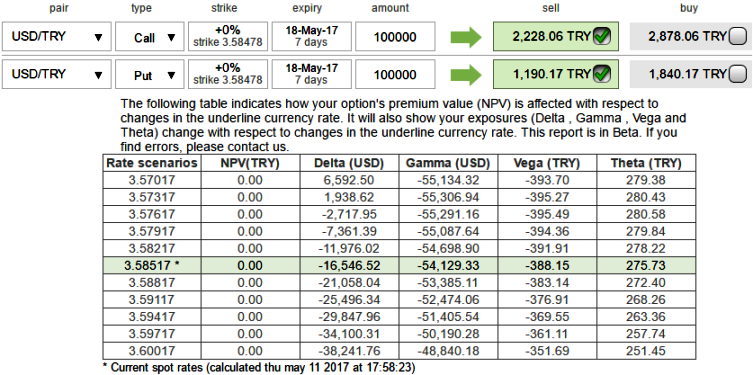

Option Strategy (Naked Strangle Shorts):

Please be noted that the IVs of 1w tenor have been flashing no dramatic prints, we think these vols are quite sensible on the above stated fundamental news.

For those whose foresee non-directional or no dramatic moves on either side and prefer to remain in the safe zone, we recommend shorting a straddle considering flat IVs or shrinkage.

Thereby, one can benefit from certain returns by shorting both calls and puts.(preferably short term for maturity is desired and ensure options greeks as shown in the diagram).

Maximum returns for the short straddle is achieved when the USD/TRY price on expiry is trading at or near spot levels only as both the instruments have to wipe off worthless. So that the options trader gets to keep the entire initial credit taken as profit.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate