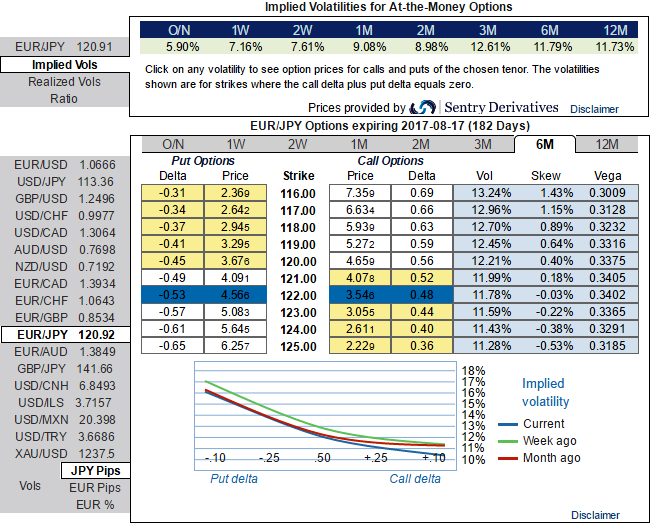

The EURJPY volatility surface is currently offering very attractive opportunities, as ATM volatility is rich and 6m/1y skews are excessively priced. Here, we recommend a couple of trades taking advantage of both the volatility and skew premiums.

In the volatility space, going short a 6m variance swap provides extremely high-profit odds. EURJPY 6m realized volatility has spent 78% and 89% of the time below the current variance swap bid level since 2007 and 2011 respectively.

We keep our EURJPY bullish bias as a directional reflation trade, which can be advantageously expressed via a zero-cost 3m topside seagull strikes 123.1715/121.1217/125.

#1 Volatility trade: go short EURJPY 6m variance swap @14.3 (EUR indicative bid).

Trade risks: 6m realized volatility below 14.3 in 6m. Investors receive or pay the squared difference between the 14.3 strike and the terminal realized volatility and face unlimited losses if realized volatility is beyond this strike level.

#2 Directional trades: Buy EURJPY 3m topside seagull strikes 123.1715/121.1217/125 Zero cost (indicative offer, spot ref: 120.9220).

Trade risks: unlimited below 123.1715. The structure is buying a standard call spread strikes 121.1217/125 fully financed by selling a put strike 123.1715. As such, investors face unlimited downside risk at the expiry if EURJPY trades below 123.1715.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data