We believe there are compelling macro- and micro-economic reasons for a new TLTRO, and now expect the ECB to announce a round of TLTRO funding in December or early 2019. Macroeconomic challenges are stacking up: external demand has fallen as risks related to trade, Italy, Brexit and China’s slowing growth have proliferated. As such, we see TLTRO III as an effective way for the ECB to prevent a tightening in lending conditions at a time of growing macroeconomic risks.

A new operation should be strictly targeted to deliver new loans to the private sector rather than to bond-investment or carry trades, in our view. Focusing the TLTRO on supporting the real economy should lessen any stigma that could be attached to banks’ use of the facility. The TLTRO rate could be equal to the average of the policy rates during the life of the operations – depo or refi rate – depending on whether the lending targets are met.

EURJPY IV skewness:Please be noted that the positively skewed implied volatility (IVs) of 2m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts of these tenors signal that the underlying spot FX likely to break below 124 levels so that OTM instruments would expire in-the-money. The spot may trend around those strikes as the holders of the options will aggressively hedge the underlying delta.

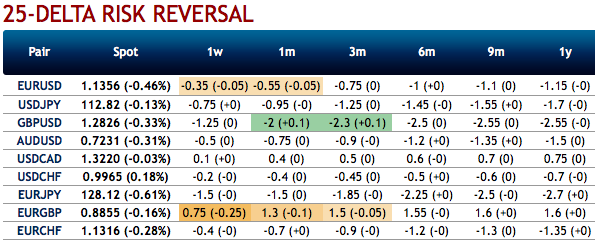

Risk reversals:Most importantly, to substantiate the downside risk sentiments as stated above, we see bearish neutral risk reversal numbers of EURJPY across all tenors that indicate bearish risks remain intact in the long run. While shrinking IVs that are on lower side, is interpreted as conducive for put option writers.

On data front, we have German IFO business climate, ECB president Draghi’s speech for this week. Eurozone PMIs are lacklustre, while manufacturing PMIs have dipped from previous 52.0 to the current 51.5 levels, while service PMIs have also been slashed from 53.7 levels to the current 53.1 levels. These are leading indicators of economic health - businesses reactions to the prevailing market circumstances.

Options Trade Tips (EURJPY):

Contemplating all the above aspects, we advocate buying 2m EURJPY ATM -0.49 delta puts for aggressive bears on the hedging grounds. If expiry is not near, delta movement wouldn’t be 1 point increase with 1 pip in the underlying spot FX. Which means if the spot FX moves 1 pip, depending on the strike price of the option, the option would also move less than 1. Source: sentrix, saxobank

Currency Strength Index:FxWirePro's hourly EUR spot index is flashing at -54 levels (which is bearish), hourly JPY spot index was at 12 (mildly bullish) while articulating at (08:04 GMT). For more details on the index, please refer below weblink:

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty