The dovish comments contrasted with recent hawkish remarks by some Fed officials who indicated that the bank could act as soon as next month to raise interest rates.

Investors and economists dialled back their rate hike expectations in wake of Yellen’s dovish outlook, with traders of interest-rate futures now seeing no rate rise before November. A gradual path to higher rates is seen as less of a threat to gold prices than a swift series of increases.

Technically, as you can observe monthly charts the yellow metal looks stronger in long term but short term trend remains in range (i.e. 1245/50-1225). After the trend has seen more than 61.8% retracement, it is now rejected below 50% fibo retracements and tight resistance at 1286.

Derivatives strategy for Gold's uncertainty:

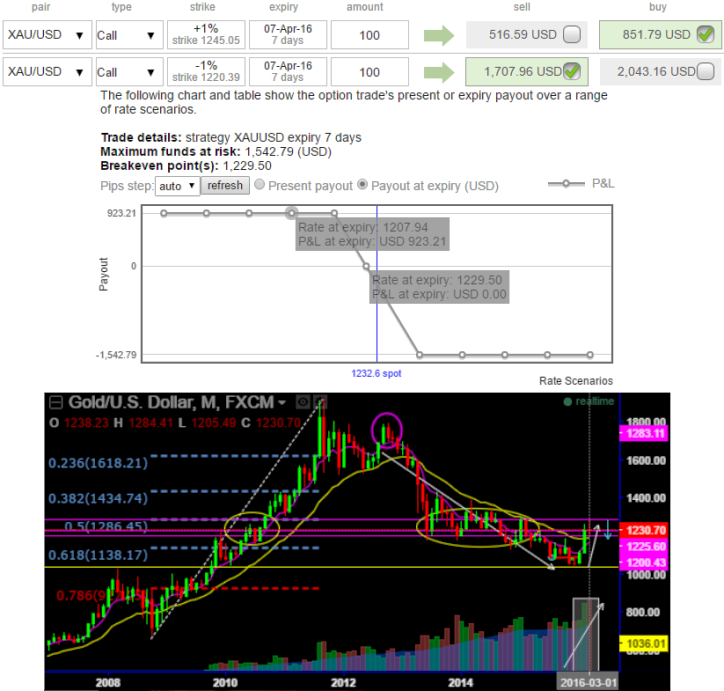

Execution: Keeping the above both fundamental and technical factors in mind, it is advisable to go long in 1M (1%) OTM 0.36 delta call while writing 1W (1%) ITM call with positive theta and delta closer to zero (both sides use European style options), this credit call spread option trading strategy is recommended when the gold spot price is anticipated to drop moderately in the near term and spikes up in long term.

Trade expects that the underlying gold spot price would drop to ITM strikes on expiration and thereafter bounce back again.

Thereby, you are speculating the gold's struggle in short run by shorting, and hedge any dramatic upside risks in long term via longs in OTM strikes which is why we've used diagonal expiries.

Margin: Yes for ITM shorts.

Return: The return is limited by ITM shorts. No matter how far the market moves below that point, the profit would be the maximum to the extent of initial premiums received.

BEP: The break-even point lies between ITM and OTM strikes as shown in the diagram.

Risk: If the underlying spot gold price rises above the strike price of the higher strike call at the expiration date, then the bear call spread strategy suffers a maximum loss equals to the difference in strike price between the two options minus the original credit taken in when entering the position..

Effect of Volatility: No effect.

Please be noted that the expiries used in the diagram are exclussively for demonstration purpose, use appropriate diagonal tenors as stated above.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One