USDJPY has been turbulent (109.132 is keenly watched) and would be volatile this week as two monetary policies are scheduled in the near future, Federal Reserve for this week, and BoJ for the next week.

With the FOMC meeting this week, there would be questions about whether the labour market strength will compel the Fed to be less generous with its monetary largesse now. We doubt it. Having come so close to a market paralysis in March, it is not going to risk nipping any nascent recovery in the US labour by hinting at any shade of hawkishness now.

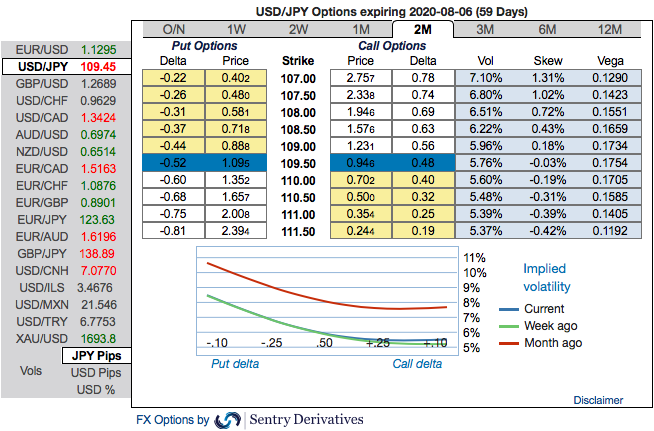

While our perspectives on Japanese yen against the dollar remains above 100 levels. If not for liquidity constrains a contained yen upside could be efficiently expressed via defensive USDJPY OTM put calendars that utilize the once in a generation skew-vol setup.

We opt for fading the curve inversion via vanillas on the weak side of the riskies to avoid left tail exposure.

At spot reference: 107.120 levels, we advocate buying a 2M/2w 108.910/102 put spread (vols 8.95 vs 8.55 choice), we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

The rationale: The positively skewed IVs of 2m tenors of USDJPY contracts are still signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 107.50 levels, whereas 2w skews signal both bullish and bearish risks (refer 1st & 2nd nutshells).

To substantiate this directional stance, one can trace out fresh bids of positive numbers for the existing bearish risk reversal numbers, this also signals current hedging interests for the downside risks amid mild upswings (3rd nutshell).

Alternatively, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds, we upheld the same positions, as the underlying spot FX likely to target southwards in the medium run. Courtesy: Sentry & Saxo

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios