The euro received a hard blow on Friday when the weak PMI for the eurozone was published, which had slipped into recession territory for the manufacturing sector.

As a result, the ESI (Eurozone Sentiment Indicator) is unlikely to cause any additional major harm to the euro today. The times for the single currency nonetheless remain tough. Everybody who is anybody within the ECB spoke yesterday.

The underlying tenor of Draghi and Co was (and it is unlikely that anything new will be added before the ECB council meeting on 10th April): improvement on growth and inflation is still expected in the second half of the year but if that does not happen the officials are ready to take action. The ECB’s most important tools are likely to be the Forward Guidance and the long term tender, so we learned yesterday.

No doubt the ECB will tolerate a few months waiting time for the data to improve, but the market will likely want to see improvement pretty soon. If that does not materialize but if instead economic data disappoints over the coming days and weeks the market could have EURAUD a brief look below 1.5330 level in the short-term and aim for the 1.6140 marks medium term. Let’s wait and see what the March inflation data will bring on Monday.

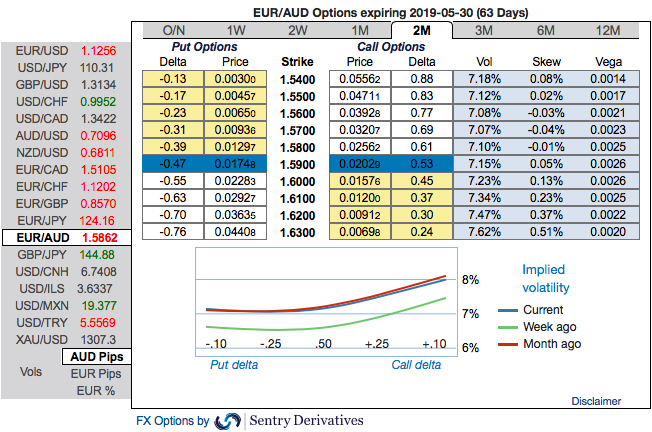

OTC Indications and Options Strategy: Please be noted that IV skews of EURAUD are stretched on either side, the positively skewed IVs of 2m tenors are signifying more hedging interests in both bullish and bearish risks. The bids for OTM calls of this tenor indicate that the underlying spot FX likely to spike up to 1.63 levels and bids for OTM puts show 1.54 levels.

Contemplating fundamental and OTC factors as explained above, it is sensed that all chances of Euro may look superior over the Aussie dollar in the near term and vice versa in the medium-term future; accordingly, we advise to hedge the puzzling swings through below options recommendations.

The execution: Buy 2 lots of at the money -0.49 delta call option of 2m tenor and simultaneously, buy at the money put option of similar expiries. The option strap is more customized version of straddles but instruments slightly biased bullish risks.

Huge profits achievable with the strip strategy when the underlying currency exchange rate makes a strong move either upwards or downwards at expiration, with greater gains to be made with a downward motion. Hence, any hedger or trader who believes the underlying currency is more likely to slide downside can go for this strategy. Cost of hedging would be Net Premium Paid + brokerage/commission paid. Courtesy: Sentrix & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index has shown -55 (bearish), while AUD is flashing at 38 (mildly bullish) while articulating at 13:28 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed