Fed Chair Powell earlier this week said policymakers are ‘closely monitoring’ risks to the US economy, in particular, how persistent any effects might be. For the time being, there appears no inclination to change policy interest rates. The potential economic impact of coronavirus remains the key focal point for financial markets, with the number of cases, jumping higher.

Meanwhile, at the House of Lords, BoE Governor Carney on Tuesday said that past experience of pandemics showed that much of output lost could be recovered later.

However, he warned that in the absence of a post-election bounce in activity, the BoE may yet add more stimulus.

As the United Kingdom has left the EU and now the horse trading is likely about a trade agreement, which will determine future relations, is going to start properly. We continue to foresee downside risks for Sterling.

OTC updates: GBP will likely take its directional cue from the read-through to Brexit whereas the size of the move will be augmented or moderated by the government’s broader policy platform, this is factored-in GBP’s FX options market.

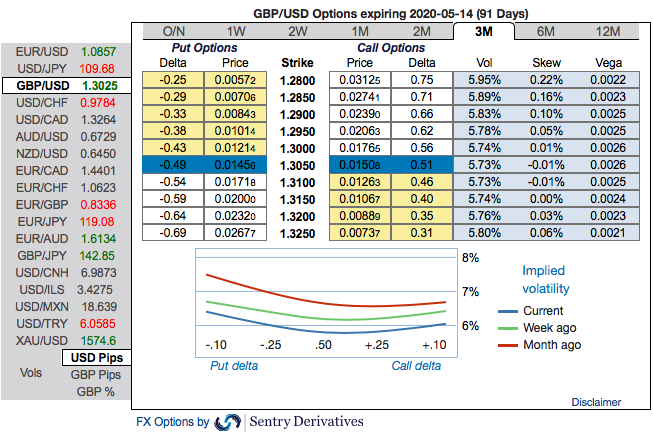

Please observe 3m GBP skews that has stretched on both the sides, hedgers have shown interests on both OTM Calls and OTM Put options.

To substantiate the downside risk sentiment, risk reversal numbers have still been signalling bearish hedging sentiments in the long run amid minor bids for upside risks. Hence, we advocate the diagonal options strategy on both hedging and trading grounds.

Strategy (Debit Put Spread): Capitalizing on the above factors, it is prudent to deploy diagonal options strategy by adding short sterling via a limited loss tail hedge: Stay short a 1M/3W GBPUSD put spread (1.33/1.29), spot reference: 1.3038 level. Courtesy: Sentry, JPM & Commerzbank

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty