The BoC was the first central bank to pivot in a more dovish direction in the summer. But after delivering its second successive rate hike in October and signaling a greater data dependency, rate expectations have corrected somewhat. The recent labor data should provide some renewed impetus to the tightening cycle as wage growth moved up to 2.4% oya compared to 0.7% only six months ago.

Admittedly the CAD curve discounts two hikes next year but thereafter it is pretty flat, so there’s scope for the longer-dated term premium to increase on evidence that labor slack is not as great as the BoC believes.

While the SNB maintains its view that the CHF is "highly valued", as the situation remains "fragile". The expectation continued vigilance from policymakers even as EURCHF 1.20 looms.

We pair CAD vs CHF because:

1) We want to avoid an outright USD short,

2) We are not comfortable adding to existing JPY shorts given the possibility of trade tensions during Trump’s Asian tour, and

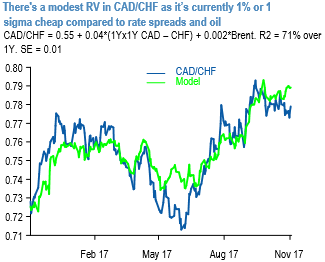

3) The demand for Swiss franc funding is likely to persist in a more reflationary global environment in which the SNB is content to sit on its hands. Swiss CPI is released on Monday – this is already at a 6-year high and above the 20Y average, but optically it is hard to get excited about inflation that is still below 1%. There is a modest RV edge to CADCHF as the cross is around 1%, or 1-sigma, cheap on a high-frequency model (refer above chart). Courtesy: JPM

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal