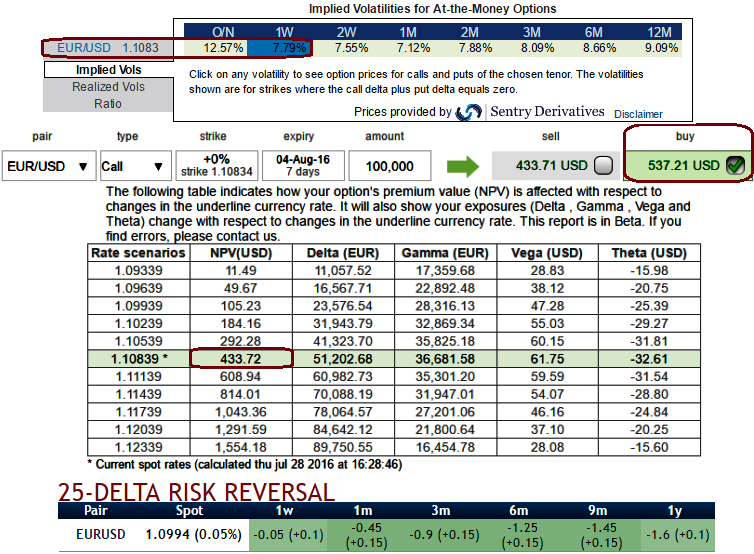

Please be noted that the ATM IVs of this EURUSD are creeping up at 7.79% and 7.12% for 1w and 1m tenors respectively. Whereas the ATM premiums are trading 24% more than NPV, the disparity between IVs and premiums are majorly due to probably yesterday’s Fed’s monetary policy decision that has been unchanged.

As a result, EUR call premiums overrated which is mismatching with the ATM IVs, while 25-delta risk reversals flash reduced bearish hedging sentiments in all expiries. The same cost does not mean the same risk profile.

There is no free lunch in financial markets: the cheaper an option strategy, the riskier it is. However, the statement is purely quantitative while appreciation of risk is to a large extent a qualitative issue.

We consider a risk reversal (RR) strategy long OTM call and short OTM put at a small cost. The strategy has unlimited topside gain and downside loss.

Alternatively, one can buy the OTM call only, but with a topside knock-out barrier (an RKO call) with a level set such that the exotic option has exactly the same cost as the RR strategy initially considered.

This time, the risk is limited to the premium, but at some point, the gains can definitely disappear. While they have the same cost, these two risk profiles can hardly be more different for an investor.

The cost of an optional strategy is merely the average of all its possible payoffs, weighted by the probabilities that the market attaches to the corresponding scenarios. There is an infinite number of ways to obtain a given expected gain, and therefore an infinite number of non-equivalent strategies with the same cost.

So, how do we meaningfully discriminate strategies if cost is not a reliable indicator?

Well, we can distinguish the strategies by adjusting the notional instead of lowering the premium:

We first need to determine the immediate consequence of dismissing cost as the main decisional input, as the depth of investors’ pockets is not unlimited. The objective is to obtain the most appropriate risk reward by dollar spent, not minimise the premium in percentage or pips.

Once the optimal strategy is identified, the notional should be adjusted according to the budget constraint and the premium, not the other way around. A notional of $10m should be used if the strategy costs 1%, or $5m if the premium is 2%.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed