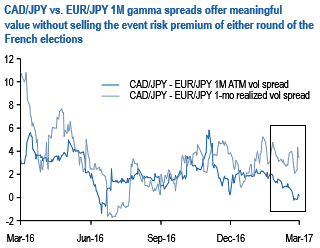

CADJPY screens extremely cheap on our 1M gamma grid while EURJPY is materially expensive (refer above chart).

CADJPY – EURJPY 1M ATM spreads is nearly flat (zero) on mids, whereas the close-to-close realized vol spread is clocking north of 3 pts., with a low of +0.3 over the past 6-months that is above current ATMs.

The reflexive pushback against selling EURJPY gamma ahead of a busy European election calendar is understandable, but it is worth noting that:

a) Realized vols are underperforming front-end implied vols by a very decent 3% pts even before the recent re-emergence of the Fed narrative this week that is raising USD-correlations and dampening volatility in non-USD crosses; and

b) 1M options do not span either round of the French elections, so selling them does not overtly fade event risk premium. The Dutch election on March 15th does fall within the 1-month expiry window, but although we do not expect it to be significant market moving but considerable impact is not priced in underlying FX markets; the European economists note that support for Wilders’ anti-EU PVV party has fallen back recently and Prime Minister Rutte has firmly ruled out a coalition with the PVV. Coalition formation will not be easy as the mainstream is divided into many separate parties, but is very likely to exclude the PVV which should keep a lid on EMU-break up risks (Euro area elections: Populist support is looking more mixed, Fuzesi).

Though the short EURJPY leg is expected to contribute the bulk of the return on the RV, the technical break weaker in CAD spot earlier this week also holds out hope that realized vols in CADJPY can hold their ground independently.

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate