The major jeopardies for to the CAD trade are:

Oil topped at $38.36 on Wednesday and upside cap is seen at $40, it is likely to remain within 35-40 range, suggesting the loonie may not move far from November 2015 highs notched a day earlier against the U.S. dollar.

Will the Bank of Canada on Wednesday undercut the loonie's nearly 10% rise above 13-year lows in January?

No change to the bank's 0.50% rate is expected but a dovish statement that acknowledges the loonie's turnaround or signals a still open door to rate cuts would leave the Canadian currency vulnerable to a pullback.

We're a short while away from the central bank's decision which is likely to remain unchanged.

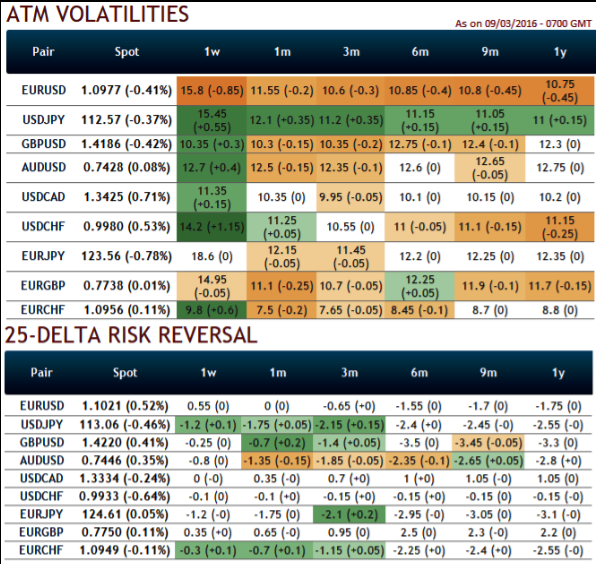

The implied volatility of ATM contracts for near month expiries of this the pair is at around 10.35% and 11.35% for 1W expiries. With many clients forced to grapple with this volatility, our efforts to conclude whether the risks to USD/CAD are symmetric or asymmetric in nature with respect to various valuation metrics.

Well, despite the announcement of all these significant economic event's CAD's vols in declining trend which is good news for option writers.

Hedging Strategy:

Keeping all the above fundamental factors in mind, it is advisable to go long in 2M (1%) OTM 0.36 delta call while writing 1M (1%) ATM call with positive theta and delta closer to zero (both sides use European style options), this bear call spread option trading strategy is recommended when the USDJPY spot FX is anticipated to slump moderately in the near term.

As we can see from the risk reversal table, the OTC market is hinting a slight recovery for CAD (see risk reversal numbers for USDCAD) but long term bull trend may resume sooner, as a result a "calendar bear call spread" option strategy is recommended.

As the underlying pair keeps dipping our ATM shorts are likely to fetch positive cashflows as these instruments would expire out of the money and initial premiums received would be the certainly pocketed in.

While the pair in next 3 months as per the risk reversal, if spot FX converges these numbers USDCAD should resume its long term bull trend and the chances of our 3M longs in 1% OTM contracts are most likely to become in the money on expiration. this way the strategy has competitive advantage than any other strategy by hedging both short term slumps and long term upside risks.

FxWirePro: Will BoC deliver dovish policy or stand pat? USD/CAD's credit spreads for smart hedging of CAD's STG and LT depreciation risks

Wednesday, March 9, 2016 2:11 PM UTC

Editor's Picks

- Market Data

Most Popular