The dollar has surged again, the dollar gains come from three fronts.

Firstly, worries that the OPEC-inspired higher oil price will generate additional US inflation and hence further Fed hikes.

Secondly, the pro strong-dollar comments from Trump’s newly appointed Treasury and Commerce Secretaries. Trump appointees have been making all the right noises: favoring tax reform over just tax cuts, renegotiating trade deals rather than canceling them and engaging rather than confronting China on the currency issue. This seems a watering down of Trump’s plans, which for us suggests the dollar should be weakening rather than gaining on the rather vague commitment to a strong-dollar policy.

And lastly, the strong US data. Consumer prices in the United States went up 1.6 pct YoY in October of 2016, up from a 1.5 pct rise in September and in line with market expectations, while GDP QoQ produced upbeat numbers (actual prints at 3.2% versus forecasts at 3.0% and previous at 2.9%).

Elsewhere, in EURUSD OTC functionality is intensifying ahead of Italian referendum that is scheduled on this Sunday (on November 4th). The complex constitutional referendum in Italy that could rock Euro area.

Like Brexit voting happened on last June 23rd that caused resilience in the euro area, this weekend another less-heralded referendum in Italy could dent another blow to Europe's status quo. Italians would be ready to cast vote on whether to amend the Italian constitution to reform the country's parliament and the way its governments are created.

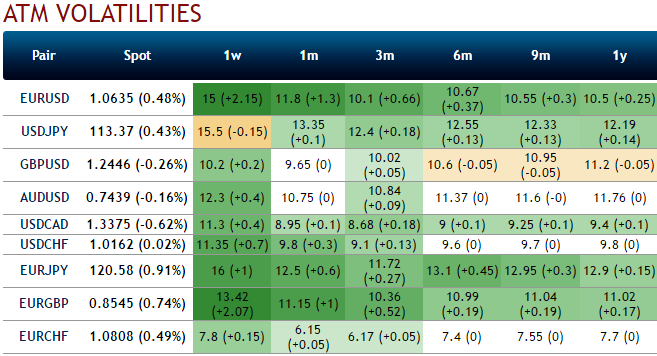

As a result, we’re now seeing turbulence in euro’s OTC markets, the implied volatility of ATM contracts for 1w and near month expiries of EURUSD are spiking sky rocketed at around 15% and 11.8% respectively which is the highest among G7 currency space.

While delta risk reversals flashing up progressively with positive numbers that signify hedging arrangements for upside risks over 1 week’s time.

The current IVs of ATM contracts are at higher levels (16.78%) but likely to perceive hover around at an average 11.5% in the long run that would divulge pair’s gain contemplating risk reversal arrangements.

Hence, considering OTC markets reasoning we think upside risks are on the cards, as result we reckon deploying ATM instruments in hedging strategies are worthwhile.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX