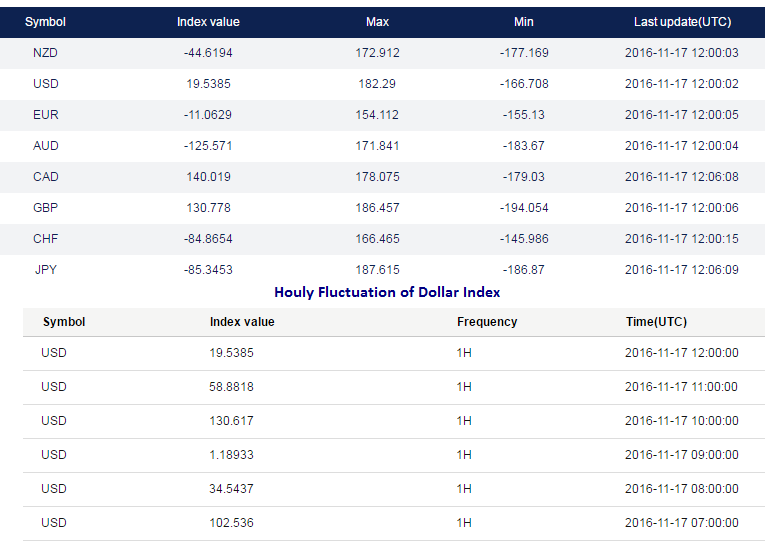

The FxWirePro’s weighted average dollar spot index that measures hourly performances of the dollar against a basket of 7 currencies, the USD has been fluctuating during the course of the day but gaining the traction for upside again ahead of today’s data streaks of economic data and the speech by Federal Reserve Governor Janet Yellen.

The pair surged to 1.0711, Wednesday’s 11-month trough of 1.06651 as dollar losing traction today, however, remained closer to the multi-year highs.

The US building permits, UK retail sales and US Fed Chair Yellen’s testimony to Congress are the key focal points for today.

US CPI data will also be keenly awaited and there may be some interest in the ECB minutes.

The euro area CPI figures are expected to confirm their preliminary ‘flash’ estimates.

OTC updates and hedging strategy (EURUSD Reverse Put Spreads):

We see option writers would be on the competitive advantage as you could probably make out from the nutshell showing implied volatilities of ATM contracts of this the pair are reducing comparing to the longer tenors (for example IVs shrinking below 9.15% for 1w tenor and rising over 10% in 1m-1y tenors).

While hedgers bet on extremely bearish pressures as the delta risk reversals with negative ticks across various tenors that signify the hedging positions are well equipped for downside risks.

But in short run, we see upside potential upto 1.0890 levels as per the market pinned risks suggest contracts expiring next Wednesday.

If you consider long term euro's valuations from last two-three months then you would come across the convergence between spot curve and risk reversals (see spot/risk reversal relation in the diagram).

Contemplating all these aspects, we see put writers opportunities in short run and long term bears remain intact.

Hence, 2w/2m reverse put spreads with strikes 1.0666/1.0890 in 2:1 ratios.

Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed