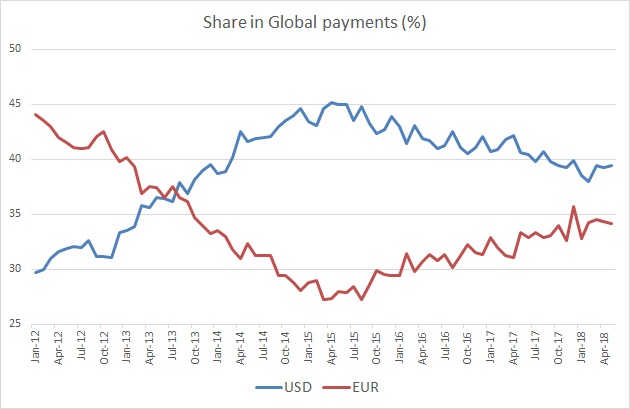

The dollar is likely to lose its number one position in the global payments as SWIFT data suggests that the spread gap between payments in euro and USD declined to the lowest in more than five years. As global geopolitical frictions rise between the United States and the rest of the world, SWIFT data shows that dollar’s share in global payments is in decline.

Though the share of the dollar has been in decline since 2015, it has recently accelerated the pace, suggesting an impact from the trade tensions. Back in 2011/12, the euro used to be the most preferred currency for global payments. However, as the Eurozone suffered debt crisis in 2012, its payment share went down from more than 44 percent in January 2012 to 27.2 percent in August 2015.

On the other hand, dollar’s share in payments declined from more than 45 percent in June 2015 to 39.4 percent as of May this year.

We suspect that we are once again nearing another major shift in the position between the euro and the dollar and in the current political background, a slip of the dollar from its top position is likely to cause some unfavorable headwinds for the dollar, which is currently trading at 94.38, down 0.15 percent for the day so far.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed