Following the sharp fall on the back of the change in finance ministers, the ZAR has now regained its value.

The immediate reaction to the Fed rate hike has been a strengthening of the ZAR against the USD despite the Fed frontloading its rate hike somewhat.

The rally is probably a relief that policy uncertainty has been removed and the market interpreting the Fed as slightly less hawkish.

However, we think it is too early to assume a sustained rally and remain cautious in the short term on the ZAR due to domestic weaknesses.

It may experience some strengthening in the ZAR during H2 2016. Hence, for now we could foresee USD/ZAR to hit 15.20 in next 1M, 15.60 again in 3M, all-time highs in 6M, and 15 levels in 1Y.

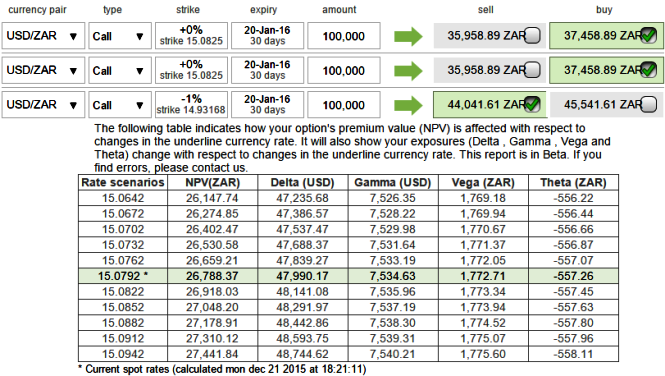

Hedging arrangements: USDZAR

The dollar seemed to take a brief halt and now back in the business, the pair is likely to persist its long lasting gaining streaks.

It is now making an attempt of recovery a bit as both technical and fundamental indicators are signaling buying sentiments again.

Hence, those who anticipate the underling currency to make a large move higher, then the strategy can be established as follows,

It is better to cover all your shorts and as shown in the diagram purchase 2 lots of 1M ATM +0.52 delta call and simultaneously short 1 lot of 3D (0.5%) ITM call with positive thetas in the ratio of 2:1.

The lower strike short calls because it finances the purchase of the greater number of long calls (ATM calls are overpriced, so we chose shorting 1% ITM calls with shorter expiry in order to reduce the hedging cost) and the position is entered for the least cost. Entering this deal for just 5.55% above NPV seems quite reasonable.

The dollar has to make substantial move on the upside for the gains in long calls to overcome the losses in the short calls as the maximum loss is at the long strike.

Give USDZAR longer time to expiration so as to make a substantial up move but prefer shorter expiries on short side (we've used identical expiries only for demonstrated purpose).

FxWirePro: Don’t get baffled in USD/ZAR’s abrupt swings – stay hedged via CRBS

Monday, December 21, 2015 1:05 PM UTC

Editor's Picks

- Market Data

Most Popular