The key UK economic data releases this week are the May PMI reports. The results of the Lloyds Business Barometer showed services activity lagging behind manufacturing. However, the manufacturing PMI release on Monday was disappointing. Meanwhile, the GfK consumer confidence survey rose to a seven-month high, aided by improving personal finances.

President Trump is making a state visit to the UK. Afterwards, PM May will stand down as Conservative Party leader on Friday. In the meantime, the Peterborough by-election (Thu) will be closely watched – in 2017, Labour won the seat with 48.1% of the vote and the Conservatives were a close second with 46.8%. If the European elections are any guide, support for the two main parties will probably fall.

Elsewhere, the Reserve Bank of Australia is the first major central bank of the G10 countries to cut its key rate, thus confirming the end of normalisation: this morning by 25bp to 1.25%. The rate cut had basically been announced, as Central Bank Governor Philip Lowe had signalled in a speech on 21st May that at its June meeting the Board would consider the case for lower interest rates. According to Lowe back then, the development in employment and inflation would be the main reasons. It could be that an even lower unemployment rate (currently 5%) was needed to exert upward pressure on inflation, according to Lowe back in May. After all, inflation disappointed in the first quarter with a decline to 1.3%, well below the inflation target of 2-3%. The reasoning remained unchanged in this morning’s statement. The market welcomes the RBA’s decision as the AUD is appreciating a bit. That illustrates: the market is demanding lower interest rates as a means of protecting against possible economic weakness. As a result, the pressure on the Fed to cut rates is mounting.

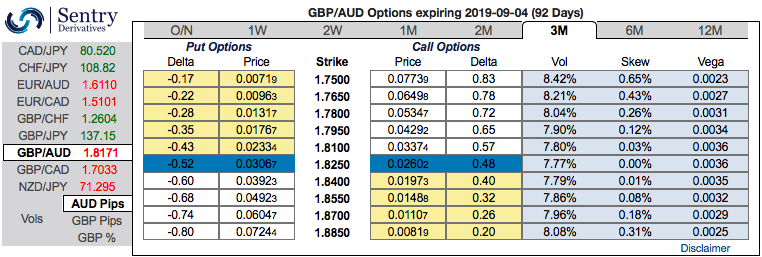

Hedging Framework:

3-Way Options straddle versus Call

Spread ratio: (Long 1: Long 1: Short 1)

The execution: Initiate long in GBPAUD 2M at the money delta put, long 2M at the money delta call and simultaneously, Short theta in 2W (1.5%) out of the money call with positive theta or closer to zero.

Rationale: Contemplating 3m IV skews that are well balanced on either side (positively skews on both OTM calls and OTM puts), we reckon that the Delta instruments are conducive to monitor directional risk so as to be aware that how much of option’s value would increase or diminish as the underlying market moves as this option tool measures the value of an option as the underlying spot FX moves. Well, ahigher (absolute) Delta value is desirable on long leg in the above stated strategy. Whereas, the Theta is positive on short leg; as the time decay is good for an option writer (that’s why we’ve chosen narrowed expiry).

We reiterate, in the prevailing puzzled environment you could observe that the momentary bulls of GBPAUD has currently been trading in non-directionally but with some bearish pressures. Hence, we advocate the above hedging strategy with cost effectiveness that could hedge regardless of the swings on either side. Courtesy: Sentry, Lloyds & Commerzbank

Let’s now quickly glance at the FxWirePro’s Currency Strength Index: Hourly AUD spot index is flashing 43 (which is mildly bullish), while hourly GBP spot index was at shy above -84 (bearish) at 13:02 GMT.

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different