Bearish USDJPY scenarios observed to 90 levels, if:

1) Dollar weakness intensifies sharply on US-specific idiosyncratic factors;

2) Assessments for the prospect of a V-shaped global growth recovery are significantly tested; 3) Political uncertainty dominates the near-term narrative for Japan with negative spillovers into Japanese equities.

Bullish USDJPY scenarios observed to 120 levels if:

1) The outlook for the global economy recovers more sharply than expected on a successful vaccine;

2) Momentum in JPY selling flows related to outward portfolio investment and FDI repeats on a similar exceptionally large scale as seen in 1Q’20.

OTC Updates & Options Strategy:

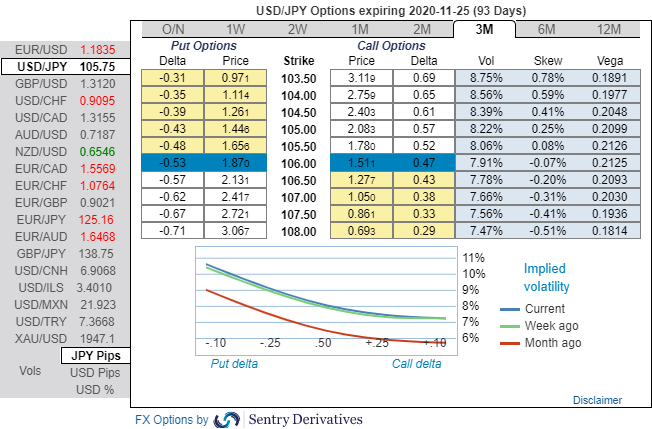

While our perspectives on Japanese yen against the dollar remains towards 103 levels. If not for liquidity constrains a contained yen upside could be efficiently expressed via defensive USDJPY OTM put calendars that utilize the once in a generation skew-vol setup.

We opt for fading the curve inversion via vanillas on the weak side of the riskies to avoid left tail exposure.

At spot reference: 105.820 levels, we advocate buying a 2M/2w 105.999/103.500 put spread (vols 6.72 vs 6.14 choice), we would like to maintain the ITM long leg with the diagonal tenors on hedging grounds.

The rationale: The positively skewed IVs of 2m tenors of USDJPY contracts are still signifying the hedging interests for the bearish risks. We see bids for OTM strikes up to 103.50 levels (refer 1st nutshell), whereas 2w skews signal both bullish and bearish risks.

To substantiate this directional stance, one can trace out fresh bids of positive numbers for the existing bearish risk reversal numbers, this also signals current hedging interests for the downside risks amid mild upswings (2nd nutshell).

Alternatively, shorting USDJPY futures contracts of mid-month tenors have been advocated, on hedging grounds, we now like to uphold the same positions as the underlying spot FX likely to target southwards up to 103.50 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentry, Saxo & JPM

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures