Sterling has been the underperformer among G10 FX space, thanks to the chaotic Brexit process to date. The Q1 outlook for cable is still binary: either a friendly Brexit or not.

It remains more expensive to hedge against strong GBP depreciation, which means that an orderly Brexit in whatever shape is still seen as being more likely. However, the risk of things going wrong is high and as a result, we regard any GBP appreciation with much scepticism.

Even if you see any fresh positive bids in risk reversals to the existing bearish setup, it should not be perceived as the bearish scenario changer.

The UK Parliamentary developments ahead of next Tuesday’s “meaningful” vote will continue to dominate the domestic focus through today’s session, as we go into the third day of debates on the EU withdrawal agreement in the House of Commons. The recent passing of two important amendments - one limiting the government’s ability to use fiscal policy in the event of a ‘no deal’ scenario (not approved by MPs) and the other requiring the government to report back to the Commons on its ‘Plan B’ within three sitting days (by 21 January) if PM May’s deal is rejected – has seen the implied bookmaker odds of a ‘no deal’ in March fall from 35% to 20%. Research by BBC Politics suggests the government may lose the vote by a 200+ margin.

Data wise, we forecast November GDP will show the UK economy continued to grow through the last quarter of 2018, in spite of ongoing concerns about the potential impact of Brexit. We expect a monthly rise of 0.2%, which would result in a rolling three-month rate of 0.3%. The latter figure suggests that Q4 GDP growth may be close to half of the 0.6% growth rate seen in the third quarter of last year. A likely slowdown in final demand may be partially offset by firms stepping up their preparations ahead of Brexit. Survey evidence suggests that this may be happening in the manufacturing sector. Accompanying the GDP release will be the industrial production report, which we forecast to show a strong rebound in manufacturing output by around 0.8%.

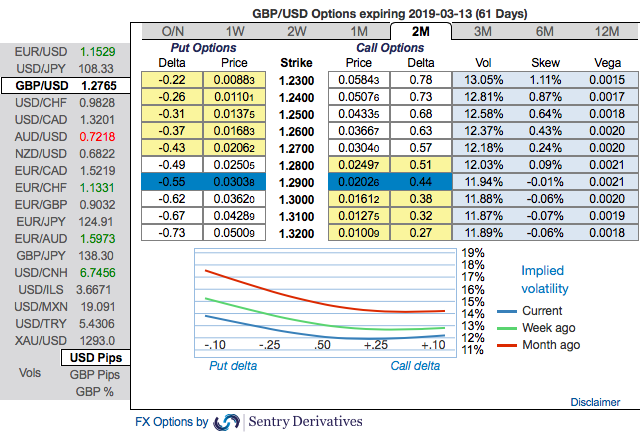

OTC updates:

Sterling appears to be untradeable and remains in the firm grip of the ongoing Brexit drama, amid this uncertainty, the British currency doesn’t seem to have discounted most of the bad news on current levels still.

No positive shifts were observed in GBPUSD negative risk reversals, but 2m IV skews have still been indicating bearish risks. Hence, major downtrend continuation shouldn’t be panicked amid the broad based bearish outlook. To substantiate this downside risk sentiment, risk reversals have also been bearish neutral which means bears are fairly positioned, while no traces of bulls in the near-run. Courtesy: Sentrix, Saxo and Lloyds bank

Currency Strength Index: FxWirePro's hourly GBP spot index is flashing 89 (which is bullish), while hourly USD spot index was at -118 (bearish) while articulating (at 11:31 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch