Euro crosses are struggling ahead of the main event which is the ECB policy announcement at 12:45GMT and Christine Lagarde’s maiden press conference from 13:30GMT. EURJPY has been gaining from the last 3-4 days, the pair spiked from the lows of 119.991 levels to the current 120.931 levels. However, the major downtrend of this pair remains intact 121.500 levels.

The fact that for ECB President Christine Lagarde everything to do with monetary policy is uncharted territory means for the market that the two sides will have to get to know and used to each other first.

No change to policy settings are expected today after the announcement in September of a (contentious) package of measures, including lower interest rates and the resumption of QE.

It appears that the bar to more ECB stimulus is high, with a number of officials voicing concerns about policy side effects. Moreover, Lagarde will be keen to heal divisions among policymakers and will call again for more active fiscal policy.

The ECB’s updated economic forecasts are expected to show little change, with GDP growth and CPI inflation previously forecast at 1.2% and 1.0%, respectively, for 2020. There will be particular focus on the 2021 CPI forecast, previously seen at 1.5%, and a new forecast for 2022.

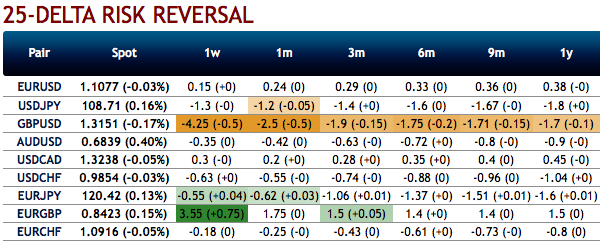

OTC outlook: The positively skewed IVs of 3m tenors are signifying the hedging interests for the bearish risks. The bids for OTM puts expect that the underlying spot FX likely to show further dips so that OTM instruments would expire in-the-money (bids up to 118.50 levels).

Most importantly, to substantiate the above indications, we could see some minor positive shifts in existing bearish risk reversal (RR) set-up of EURJPY that indicates the long-term hedging sentiments across all tenors are still substantiating bearish risks amid minor abrupt upswings in the short-term. Please be noted that 3m negative RRs suggest the overall OTC hedging sentiments for the further bearish risks. Hence, we advocate below hedging strategy contemplating the current OTC indications.

Options Strategy: Contemplating above factors, we’ve advocated buying 3m EURJPY (1%) ITM -0.79 delta puts for aggressive bears on hedging grounds as the mild abrupt upswings were contemplated earlier.

Short hedge: Alternatively, we advocated shorts in futures contracts of mid-month tenors with a view to arresting potential dips. since further price dips are foreseen we would like to uphold the same strategy by rolling over these contracts for January month deliveries ahead of ECB monetary policy. Source: Sentrix, Saxo & Commerzbank

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential