We do not chase the strong price action in higher yielding currencies and stay neutral on ZAR, TRY and RUB. EM local markets have staged an impressive rally in the past three months. The question for investors is whether or not to chase the strong price action in higher yielding currencies.

In EMEA EM local markets, we think the answer is ‘no’. Stretched risk premia, unattractive valuations and upcoming event risks (Fed, European politics) suggest the momentum of the rally has peaked for now. We, therefore, stay neutral in high yielding currencies. The conviction in bearish CEE FX positions is reinforced on underpriced European political risks in EM. A number of indicators suggest the EM FX rally is running out of steam, in our view:

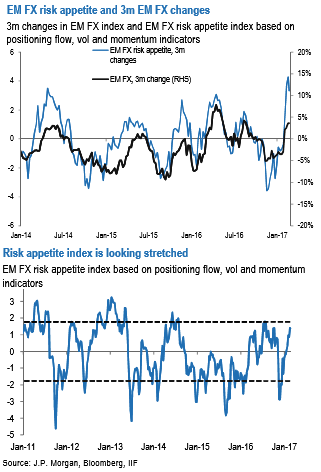

First, our EM FX risk appetite index looks increasingly stretched. The above charts show that the EM FX risk appetite index, based on a number of risk, flow and positioning metrics, is heading towards stretched levels. Historically, changes in this index have co-moved closely with EM FX. Admittedly, we have underestimated the extent to which risk appetite would recover from the lows in December, and have successively closed bearish EM FX positions (taking profits on TRY, and being stopped out of long USDRUB) in response.

Second, the performance of EM currencies has significantly diverged from the Dollar Index.

We believe that political risk into the French elections is priced more appropriately in bonds (but not in currencies) than going into the Brexit and US vote.

Higher yielding currencies are fair-value to expensive at current levels.

The histogram chart shows that EMEA EM currencies are currently either around the fair value (TRY and ZAR) or expensive (RUB) on the high-frequency models.

A positive % deviation indicates the USD/EM (EUR/EM) cross is trading too high; a negative % deviation indicates the USD/EM (EUR/EM) cross is trading too low. Deviations are from “intuitive” short-term models.

As such, both top down and bottom up indicators point to there being little value in chasing the momentum in higher yielding currencies in EMEA EM.

Second, we also note that ILS, the only currency in EMEA EM on which we were bullish, is also looking expensive at current levels, which leads us to close out our EURILS put spread in profit upon expiry.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?