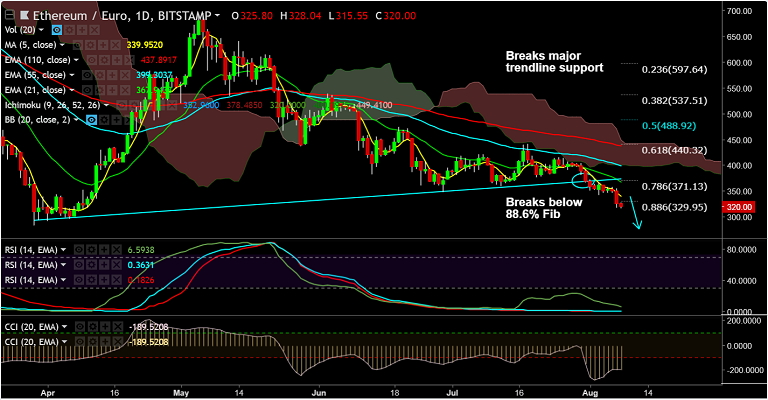

- ETH/EUR extends weakness below 88.6% Fib, hits new 4-month lows at 315.55, bias bearish.

- SEC's decision to postpone approval for listing of the Cboe VanEck/SolidX exchange-traded fund (ETF) backed by Bitcoin (BTC) to September 30 weighs.

- The pair is trading 1.84% lower on the day, upside capped below 88.6% Fib and 5-DMA.

- Momentum is with the bears. Stochs and RSI are sharply lower. We see -ve DMI dominance and MACD supports downside.

- Price action is below major moving averages and the daily cloud. Scope for test of 2018 lows at 283 level.

- On the flipside, 5-DMA is immediate resistance at 339. Break above could see test of 21-EMA at 367 ahead of 50-DMA at 387.

Support levels - 296.20 (Apr 6 low), 283 (Mar 29 low)

Resistance levels - 329.95 (88.6% Fib), 339 (5-DMA), 367 (21-EMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-ETH-EUR-breaks-major-support-at-370-targets-886-Fib-at-330-level-1410613) has hit all targets.

Recommendation: Book partial profits. Trail SL to 340. Hold for 300/ 285.

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 73.8202 (Neutral) at 0745 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.