The Sterling appreciated notably in the recent times. Anyone looking for a convincing reason behind this move would probably be dissatisfied.

We individually reckon that it is unconvincing and unsustainable as the reason behind it that is being cited was Prime Minister Theresa May’s assertion to British commerce that Great Britain would not leave the EU without a trade agreement or a transitional solution. In particular, as she made these comments hours before the move in the GBP exchange rates.

Moreover a “hard Brexit” is still not off the agenda in my view. Of course, it is in the interest of Great Britain not to leave the EU without some kind of agreement, the only difficulty will be convincing the EU-27 of this.

In this context, May still does not explain how she intends to secure access to the single market without having to accept the freedom of movement. The potential for a reversal in Sterling thus remains high.

The current resilience of sterling, especially versus the dollar and euro, would be tested in the coming days. After a brief rally attempt around the London open yesterday, the cross fell aggressively to extend the reversal from the highs set post-referendum.

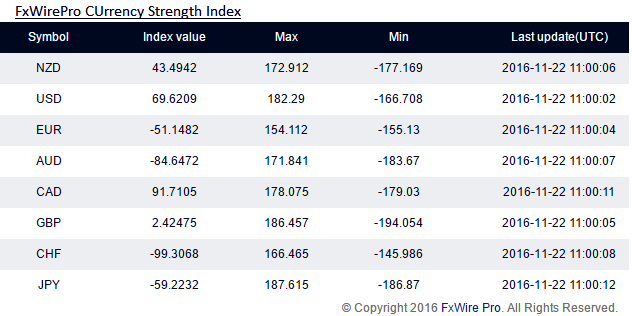

We are now about 12.5% away from that peak, and FxWirePro currency strength index that measures the price performance of basket of currencies on hourly basis indicates pound trading in neutral mood, while euro and dollar are trading little bearish and bullish respectively as we head into the Autumn Statement in the UK and Euro area PMIs for tomorrow. Ahead of that, the focus on the UK’s fiscal outlook will begin today with the release of the October public finances report. The shifting policy focus in the US has inevitably raised questions over whether we will see a policy pivot in the UK.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed