Traders in commodities from sugar to oil may face tougher regulation in the European Union as policy makers wrangle over new rules intended to curb speculation.

European Parliament lawmakers warn that the EU’s latest proposals for preventing market abuse and spikes in food prices aren’t strict enough.

The European Securities and Markets Authority (ESMA) sent the latest version of the rules to the European Commission back in May, and the EU’s executive arm has been considering its next move ever since. ESMA set out a method for calculating position limits for physically settled and cash-settled commodity derivatives, which are intended to reduce speculation and systemic risk.

Contemplating the precious metal that is more sensitive to moves in U.S. rates, which lift the opportunity cost of holding non-yielding assets such as bullion.

Responding to the Fed’s deferral policy actions, Gold futures for December delivery on the Comex division of the NYME touched an intraday peak of $1,339.30 a troy ounce, the most since September 8th. Eventually, those who are long in spot gold, taking fundamental factors and their impact on spot prices of this precious metal into account, hedge must be attuned with as underlying price changes

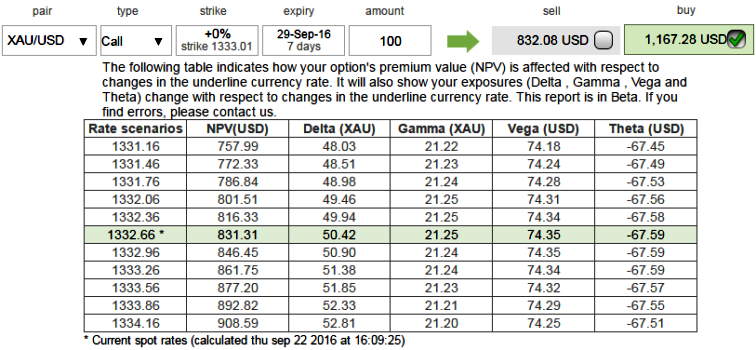

A run through on delta hedging considering gold as the commodity:

For instance, let’s visualize a bullion investor is long in 100 units of gold on spot and his cause of concern is about downside risks in the prices of his commodity. In order to bring in the effect of delta hedging for his portfolio, we want you to follow below steps.

Step 1: Check the call option’s delta value using the sensitivity table.

In this example, the delta of the long Call XAU/USD option of 1w expiry is 0.51.

Step 2: Initiate the converse position in the underlying bullion market. In this case, Short 51 units of gold against USD. You have now created a delta hedge on your Put option.

We prefer this process with a view to keep a perfect neutral delta hedge as the delta of the option would travel as the underlying market keeps shifting, you would need to constantly adjust your position in the underlying market.

By that we mean, in summary, the delta hedge is a strategy to reduce market movement risks involved in an option’s trade whilst sustaining the opportunity to profit from the change in volatility. If you are long in an option, the time decay will work against you, whilst if you are short the decay is with you.

To do this every time the market moves is an impossible task and the spread charges will eat up your profit.

Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data