It's a green day for euro, almost all economic figures that drive euro are printed into positive data.

Lets begin with German ZEW that signifies institutional investors sentiments towards euro area's economic sentiments, these figures were able to flash an upbeat 59.7 which is way beyond both forecasts and previous prints at 54 and 55 respectively.

ECB has released current account transactions were at €26.4 bln which way beyond forecasts at €19.6 bln and previous flash at €20.4 bln.

While Euro area CPI for December was at 0.0% vs forecasts were at -0.1%.

This Thursday ECB President Draghi faces a tough task curbing the appeal of the single currency. The euro jump in recent trend is major due to the massive price drops in crude prices to $28 way below the ECB projections for 2016 ($52.2) and the causing drop in inflation prospects present a stern encounter to the distributed governing council.

Put holders from last two days must be happy with the current levels of this pair (EURAUD spot fx at 1.5665) after dips from the highs of 1.6076.

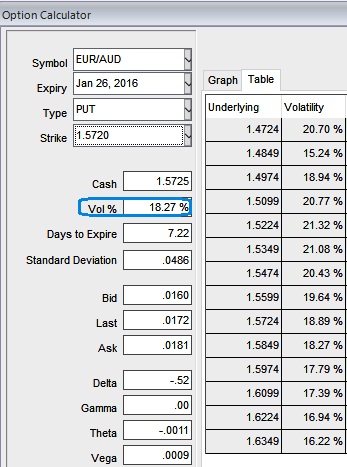

On the other hand, we advise OTM shorts with shorter expiry which must be suitable for HY vols, the IVs of ATM puts are likely to perceive 18.27%, so go long in 2 lots of 2W (1%) ITM vega puts that should be on the job with prevailing dips which is again suitable instrument for HY vols, for now more downside potential is seen which is underway as we see bearish technical indication (Bearish Gartley) on daily charts.

The pair has broken channel line support earlier at around 1.5917 and 1.5506 levels and we can get long term bearish trend confirmed with 61.8% retracement after the formation of gravestone doji pattern in late August.

EURAUD spot FX is currently trading at 1.5665, from here onwards our 2 lots of 15D longs on ITM strike vega puts would start maximizing profits utilizing higher implied volatilities considering the current short term downtrend.

The recommendation for now is Vega back spread which is generally dominated by the long options the more time there is to expiration and the closer EURAUD is to the strike price of the long options.

15 days of expiration on longs sets up generally the more positive vega the back spread. The reason for this is that far from expiration, the difference between the vega of one strike and the next is relatively small. This is an income strategy. You are looking for a net credit if the pair stays within a range or rises.

In our opinion this pair creates best swing trading opportunity, it is better to use these rallies and stay calm with earlier ITM long puts and any minor upswings can be utilized OTM put writings.

FxWirePro: EUR/AUD IVs spike higher, put writers on competitive advantage – long vega puts in PRBS to derive more yields

Tuesday, January 19, 2016 1:14 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary