The rejection at the stiff resistance of 1.5678 levels forms shooting star pattern candle that evidences slumps to hamper the consolidation phase in the major trend.

Historically, you could make out the prices have tumbled as it failed to sustain above this resistance level.

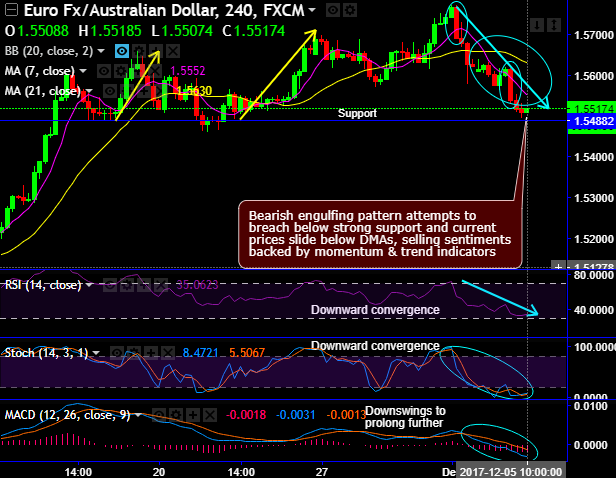

On intraday terms, two bearish engulfing pattern candles have popped up at 1.5690 and 1.5536 levels respectively. Consequently, bears attempt to breach below strong support at 1.5488 levels and the current prices slide below DMAs to substantiate weakness in this pair.

Most noticeably, the selling sentiments are backed by both momentum & trend indicators.

Even if you see any abrupt rallies that seem to be unlikely to sustain above 7-DMA levels for today (refer daily chart).

The major trend that was sliding southwards through a sloping channel, has now been able to break-out this channel resistance, extended the consolidation phase.

However, extended upswings can be foreseen only upon break-out above stiff resistance of 1.5678 levels. Because both leading oscillators pop up overbought noises at this juncture.

Having said that, we conclude by stating, overall, the major trend seems slightly edgy for now, while the short-term trend may intensify bearish sentiments upon breach below strong support of 1.5488 levels.

Trading tips:

Contemplating prevailing bearish sentiments, on trading grounds, it is advisable to snap deceptive rallies and deploy tunnel spreads with upper strikes at 1.5553 and lower strikes at 1.5488 with a view to arresting downside risks in the underlying spot movements.

Currency Strength Index: FxWirePro's hourly EUR spot index has turned into -50 (which is bearish), while hourly AUD spot index was at 86 (which is bullish) at 10:42 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit: