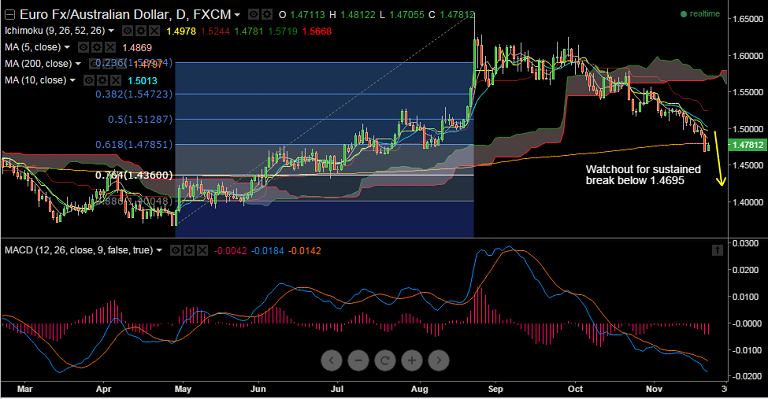

The Australian dollar held near four-month highs against a soggy euro as expectations of further easing by the ECB underpinned demand for carry trades.

- EUR/AUD dropped to 1.4696, its lowest since July, after shedding 1.5 percent on Friday, and was last trading at 1.4782 after paring some of Friday's losses

- The pair has retraced over 50 % Fibo of the 1.3677 to 1.6584 (Apr to Aug rise), momentum studies, 5, 10 & 20 DMA's trend south - bearish setup in place

- A sustained break under 1.4695 could see a retracement all the way to 1.4400 with little chart support seen until then

- 200 DMA at 1.4797 which gave way on Friday is now the initial resistance ahead of 1.4869 (5 DMA)

Recommendation: Good to sell rallies around 1.4790, SL: 1.4870, TP: 1.4400

FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption

FxWirePro:EUR/AUD neutral in the near-term, scope for downward resumption  NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds

NZDJPY Retraces on Tokyo CPI: Bulls Eye 95.00 Target as Support Holds  FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish

FxWirePro: GBP/NZD downtrend loses steam but outlook still bearish  EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186

EUR/JPY Coils Tightly Above 183.20 – Bulls Ready to Push Toward 186  FxWirePro- Major European Indices

FxWirePro- Major European Indices  Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone

Pound Sell-Off Accelerates: GBP/JPY Drops to 209.93, Eyes Major Support Zone  FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo

FxWirePro:EUR/AUD upside limited, scope for a dve through a key fibo  FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/NZD attracts selling interest, vulnerable to more downside  FxWirePro- Major Pair levels and bias summary

FxWirePro- Major Pair levels and bias summary  FxWirePro: NZD/USD edges up, remains on front foot

FxWirePro: NZD/USD edges up, remains on front foot  FxWirePro: EUR/NZD recovers slightly but bears are not done yet

FxWirePro: EUR/NZD recovers slightly but bears are not done yet  FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook

FxWirePro: AUD/ USD edges up as Australian dollar gains on hawkish RBA outlook  FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data

FxWirePro: USD/JPY dips as yen gains after Tokyo CPI data  FxWirePro: GBP/AUD extends drop, vulnerable to more downside

FxWirePro: GBP/AUD extends drop, vulnerable to more downside  Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize

Bitcoin Stuck in $66K–$67K Cage – Break $70K and $78K+ Becomes the Prize