In this week’s calendar, ECB and BoC’s monetary policy announcements have been the major data events.

For BoC to be repriced by a hike as a partial catch up to the Fed’s level and pace, and for some temporary positive risk premium helped by a covering of shorts. Despite the legislative hurdles remaining after NAFTA transforming to successful USMCA (and thus precluding a true best-case scenario for now), all of the above factors appear to be shifting in a direction that supports CAD strength over the coming months.

On the flips side, a probable improvement in rate spreads in the euro’s favour as the ECB delivers rather more tightening than the curve prices. We continue to believe that delivery of early stage ECB tightening should be more impactful for FX than an extension of late-cycle Fed hikes as the market is liable to become more concerned about the longevity of the US cycle if the Fed is confronted.

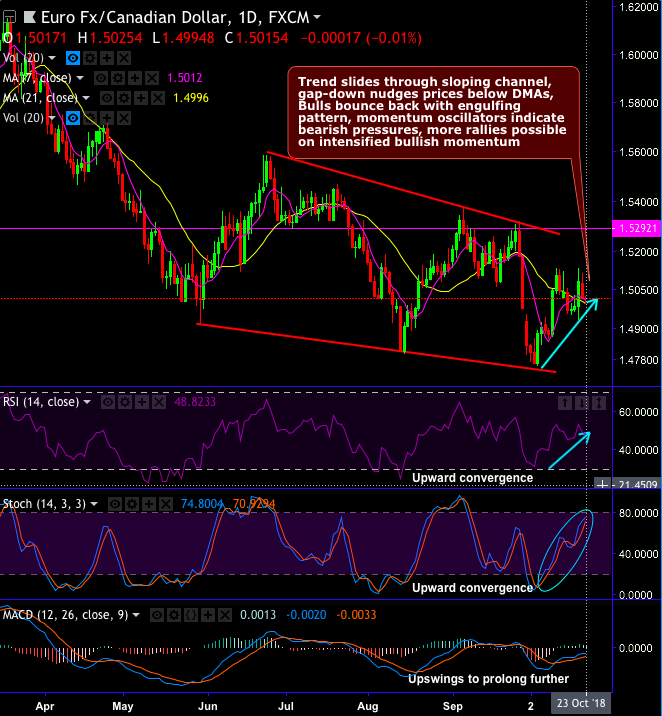

Technically, although EURCAD bearish candles with big real bodies are signifying the weakness of this pair in the major trend and the minor trend slides through sloping channel, gap-down candlestick pattern nudges prices below DMAs, while the bulls bounce back with engulfing pattern, the momentum oscillators indicate bearish pressures, more rallies possible on intensified bullish momentum.

While both momentum and trend indicators still signal bullish pressures.

On a broader perspective, the major trend spikes through rising channel, shooting star pops-up exactly at channel resistance followed by dips, and hammers at channel support in the past (refer monthly plotting), but the major trend through rising channel are not backed by momentum confirmation (refer monthly chart).

Both RSI and stochastic curves are showing the downward convergence to the price slumps (monthly). This indicates the lingering bearish sentiments. The lagging indicators have been indecisive but slightly bearish bias.

Hence, for today, contemplating above technical rationale, at spot reference: 1.5027 levels, buying tunnel spreads are advocated with upper strikes at 1.5075 levels (i.e. about northward 50 pips from the spot level) and lower strikes at 1.4931 levels(i.e. 90-100 pips southwards), the strategy would likely fetch us handsome yields with magnified effects as the underlying spot FX keeps dipping but remains above lower strikes on expiration.

Alternatively, shorting futures contracts with mid-month tenors is advocated on hedging grounds.

Currency Strength Index: FxWirePro's hourly EUR spot index is flashing at -33 (which is mildly bearish), while hourly CAD spot index was at -66 (bearish) at 09:19 GMT.

For more details on the index, please refer below weblink:

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms