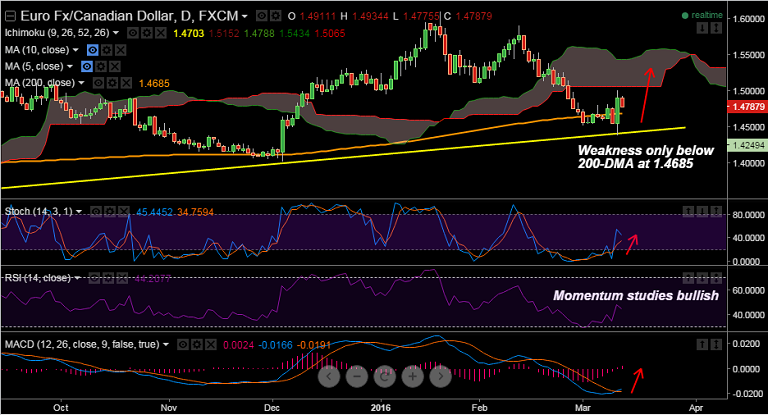

EUR/CAD reversed the dips to 1.4389 post ECB and has edged higher to currently trade at 1.4787 levels.

- The pair has closed above 200-DMA and weakness can be seen only on close below 200-DMA currently at 1.4685.

- Momentum studies are bullish, Stochs abd RSI have turned higher from oversold levels and MACD shows a bullish crossover.

- Yesterday's downside has held strong trendline support at 1.4385 levels, bullish invalidation only on breaks below.

- Cloud base at 1.5055 offers strong resistance on the upside, while 200-DMA at 1.4685 is strong support on the downside.

Recommendation: Good to long dips around 1.4775, SL: 1.4685, TP: 1.4990/1.50/1.5055