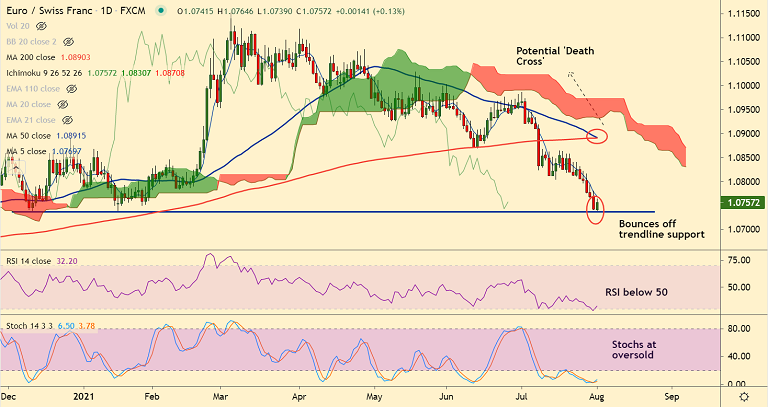

EUR/CHF chart - Trading View

EUR/CHF was trading 0.15% higher on the day at 1.0759 at around 10:45 GMT, outlook remains bearish.

The pair has paused 5-day bearish streak and has edged higher after upbeat German retail sales and eurozone PMI data support the euro.

German retail sales increased much more than expected in June, data released by the Federal Statistics Office showed earlier on Monday.

German retail sales rose 4.2% on the month in real terms after an upwardly revised jump of 4.6% in May, beating forecasts at 2.0% by a large margin.

According to the latest data released by Markit, eurozone July final manufacturing PMI printed at 62.8 vs 62.6 in the preliminary reading.

The single currency buoyed after upbeat data. Price action has bounced off major trendline support at 1.0740.

Technical bias is strongly bearish, but oversold oscillators might cause some retrace in price from lows.

A potential 'Death Cross' (bearish 50-DMA crossover on 200-DMA) is likely to keep upside limited.

Break below trendline support will plummet prices. Next major bear target lies at 88.6% Fib at 1.0716.