Refer EUR/CHF chart on Trading View

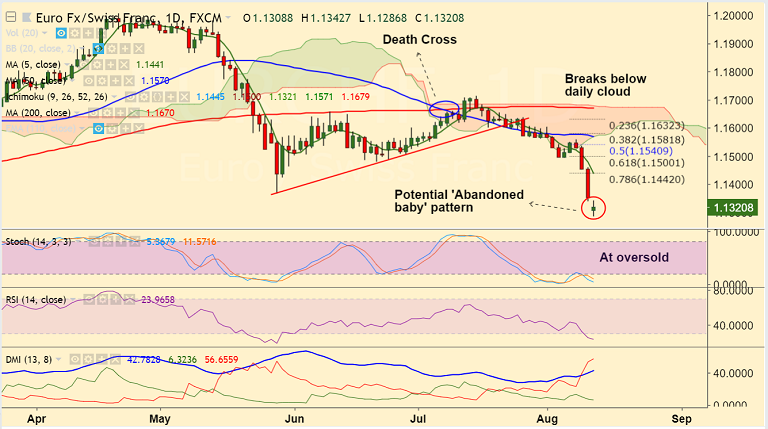

- EUR/CHF hits 12-month lows at 1.1286 before paring some losses to currently trade at 1.1321.

- The pair opened with a bearish gap over Turkey crisis and concerns of contagion effects.

- Speculation that the Eurozone banking sector's vulnerability to the crisis in Turkey could force the ECB to adopt a dovish stance dented the euro.

- The pair has since recovered from multi-month lows and has formed a Doji on dailt and weekly charts.

- Momentum indicators are at oversold levels and the potential for a 'Bullish Abandoned Baby' pattern keeps scope for a reversal.

- Technical indicators on daily charts are still bearish. Decisive break above 5-DMA could see minor upside.

- Price has currently broken below 1W 110-EMA at 1.1371, finds next major support at weekly cloud base at 1.1229.

- Breach at cloud base could see extension of weakness. Scope then for test of 1.1106 (38.2% Fib).

Support levels - 1.1229 (weekly cloud base), 1.1106 (38.2% Fib)

Resistance levels - 1.1371 (1W 110-EMA), 1.1442 (5-DMA)

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at -56.79 (Neutral), while Hourly CHF Spot Index was at 38.3553 (Neutral) at 0915 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.