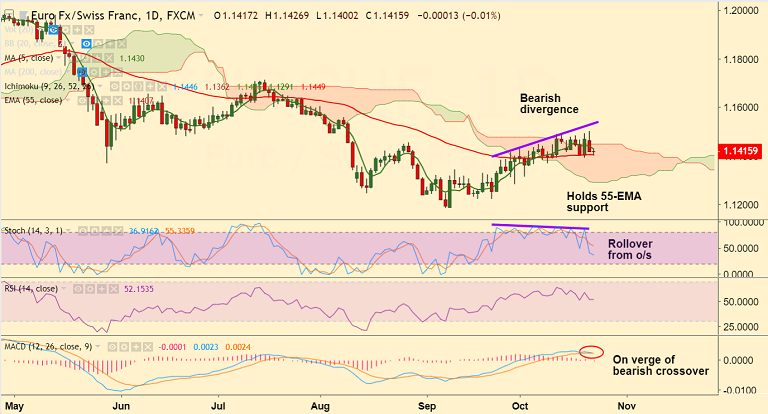

EUR/CHF chart on Trading View used for analysis

- EUR/CHF trades in tight ranges on the day, with session high at 1.1414 and low at 1.1392.

- The pair remains largely muted at 1.14 handle despite upbeat EMU CPI data.

- Data released earlier today showed headline consumer prices are expected to rise at an annualized 2.2% in October.

- While Core prices are seen gaining 1.1% over the last twelve months, both prints coming in above expectations.

- Technical indocators are neutral to slightly bullish. Breakout of cloud likely to see further upside.

- On the flipside, we see weakness below 5-DMA at 1.1387. Dip till lower Bollinger Band at 1.1352 likely.

Support levels - 1.1387 (5-DMA), 1.1352 (lower BB)

Resistance levels - 1.1416 (20-DMA), 1.1457 (110-EMA)

For details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight

AUDJPY Smashes 30-Month Peak — Buy the Dip, 112 in Sight  FxWirePro: GBP/NZD remains weak, eyes 2.2550 level

FxWirePro: GBP/NZD remains weak, eyes 2.2550 level  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target

NZDJPY Bulls in Control: Buy-the-Dip Setup Points to 96 Target  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  FxWirePro: USD/JPY builds momentum , eyes 157.00 level in the short term

FxWirePro: USD/JPY builds momentum , eyes 157.00 level in the short term  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data