The EURCHF’s projection is for a return to 1.20 by 2Q’18 and the current price behavior is well on track of this target. Bulls spike above DMAs in rising channel, sensing more buying sentiments upon bullish DMAs crossover with support from momentum indicators. In this process, the pair has managed to break-out the stiff resistance levels of 1.1715 -1.1740.

The major trend reversal prolongs upside traction after break-out of range resistance (refer monthly plotting). The buying sentiments on this timeframe have taken the current price to hit multi-months (23-months) highs of 1.1771 levels, both leading & lagging indicators to substantiate this bullish interest.

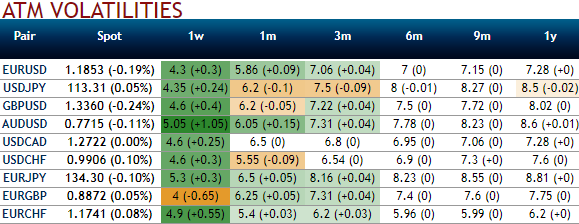

OTC outlook and Options strategy: Before we proceed further with the options strategy, let’s glance through the implied volatilities of EURCHF ATM contracts from the above nutshell, IVs of this underlying pair of 1w-1m expiries have still been the least among G10 currency segment. Usually, the lower volatile conditions are conducive for the option writers under the circumstances of the range bounded trend.

Amid the prevailing uptrend that we’ve been witnessing in EURCHF, positively skewed IVs of 1m tenor still signify the hedgers’ interests for bearish risks (bids for OTM puts strikes upto 1.1650). Please also be noted that the bearish neutral risk reversal of EURCHF does not indicate dramatic shoot up.

Thus, in order to sync with the above fundamental factors, the technical trend of the underlying price and the OTC indications, we advocate below options strategy.

From the above technical chart, it is clearly understood that the upside risks are on cards. As a result, ITM calls have been in high demand.

We formulate suitable hedging framework contemplating all the above aspects. Place call ratio spread with 1:2 ratios.

How to execute: At spot reference: 1.1768, buy ITM (1.1480) +0.66 delta call with longer expiry (let’s say, 3m tenor). Sell two lots of OTM strike calls (1.2065) of comparatively narrowed tenors (say 1m). Thereby, we’ve formulated the strategy so as to sync ongoing technical trend with the delta risk reversal.

The delta value becomes more and more insensitive as the EURCHF falls lower and lower and hence on the lower side, the delta value is zero.

On the higher side, it increases in magnitude but remains negative indicating the negative effect on the options trader position with the pair rallying.

Why call ratio spread: As the pair has made sharp rallies with minor hiccups, we see a neutral to bearish environment in near run when you are projecting decreasing volatility (see from next 1 month to 3 months it’s been gradually reducing)

Risk/Reward Profile: The risk is unlimited. The reward is the difference in the strike prices plus the net credit, multiplied by the number of long contracts.

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -3 levels (which is neutral). While hourly CHF spot index was at shy above 3 (neutral) while articulating (at 12:33 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure