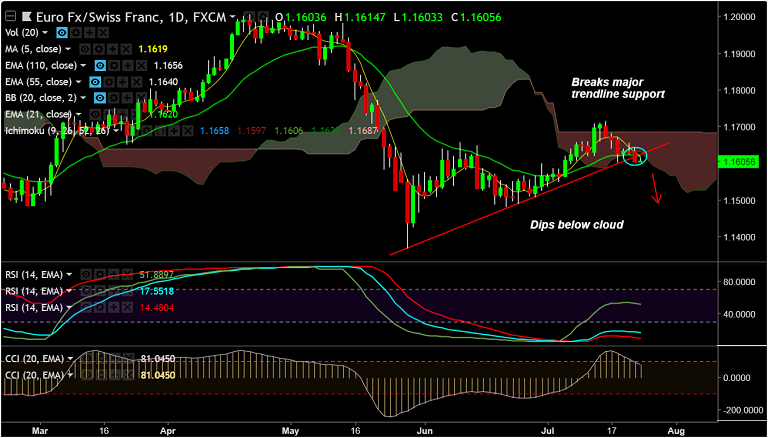

- EUR/CHF is struggling to break below 1.16 handle, bias remains bearish.

- The pair has edged higher from lows of 1.1603, but recovery lacks traction.

- Upside finds stiff resistance at 1.1620 which is converged 5-DMA and 21-EMA. Extension of upside only on decisive break above.

- Technical indicators are bearish. Stochs are biased lower and RSI has slipped below 50 levels.

- MACD is on verge of bearish crossover on signal line and we see -ve DMI crossover.

- The pair is currently hovering around 50-DMA support at 1.16, break below will see further weakness.

- Next immediate bear target lies at 38.2% Fib at 1.1581 ahead of 1.1540 (50% Fib).

- On the flipside, we see upside on break above 1.1620 and a bearish invalidation on breakout above 100-DMA.

Support levels - 1.16 (50-DMA), 1.1581 (38.2% Fib), 1.1540 (50% Fib)

Resistance levels - 1.1620 (converged 5-DMA & 21-EMA), 1.1640 (55-EMA), 1.1676 (200-DMA)

Call update: Our previous call (https://www.econotimes.com/FxWirePro-EUR-CHF-rejected-at-session-highs-good-to-go-short-on-break-below-21-EMA-1406247) is progressing well.

Recommendation: Hold for targets.

FxWirePro Currency Strength Index: FxWirePro's Hourly EUR Spot Index was at 57.0809 (Neutral), while Hourly CHF Spot Index was at 102.749 (Bullish) at 0430 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.