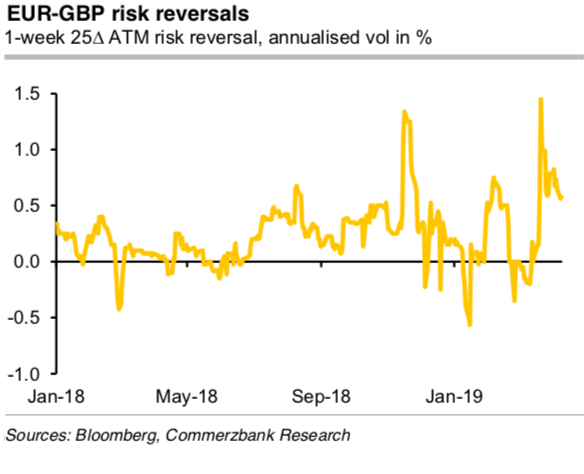

The British side would be able to reach a compromise on Brexit after Prime Minister Theresa May announced her willingness to cooperate with Labour leader Jeremy Corbyn. It was my expectation that May would abandon her or rather the Tory party’s red line so as to be able to finally submit a Brexit plan to the EU that the House of Commons had agreed to. However, we clearly stand corrected: yesterday Corbyn seemed disappointed that May had not done so. Her proposal to him did not involve the UK remaining in the customs union, which constitutes Labour’s central demand while at the same time representing the Tory’s above the red line. It does not currently look as if the two parties would even begin to approach a solution. As time is fleeting that increases the risk of a no-deal Brexit – something the FX market seems to underestimate at present (refer 1stchart).

However, that is not the only front on which May is fighting again at present. Last night the House of Lords passed legislation that limits the government’s scope in the negotiations with the EU about postponing the Brexit date. Initially, May has to get the support of the House of Commons for her proposed new date, 30th June, before taking this to Brussels. There will be a debate amongst MPs about it today. It is quite possible that they will demand a later date than envisaged by May. Sterling is likely to initially react positively to this news as it may mean that a no-deal Brexit could be off the agenda for a longer period of time. However, things are not as simple as that. After all, it is uncertain what the majority of the other EU members think about a longer postponement of Brexit.

EURGBP is trading in the midst of the current 0.8470-0.8720 range. The underlying technical outlook remains bearish, but a break of 0.8470 is needed to confirm and open a move towards the more significant medium-term 0.8350-0.8250 lows. A rally through 0.8725 would negate that bearish dynamic and suggest a return to the previous upper range, in which pivot resistance is at 0.8840/60 and key resistance remains at 0.9100-0.9170.

On a broader perspective, a decline through key 0.8350-0.8250 range lows is needed to indicate a major shift in sentiment, suggesting a move to 0.8000-0.7500. Courtesy: Lloyds & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards 76 levels (which is highly bullish), GBP is at -161 (highly bearish) while articulating (at 08:56 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis